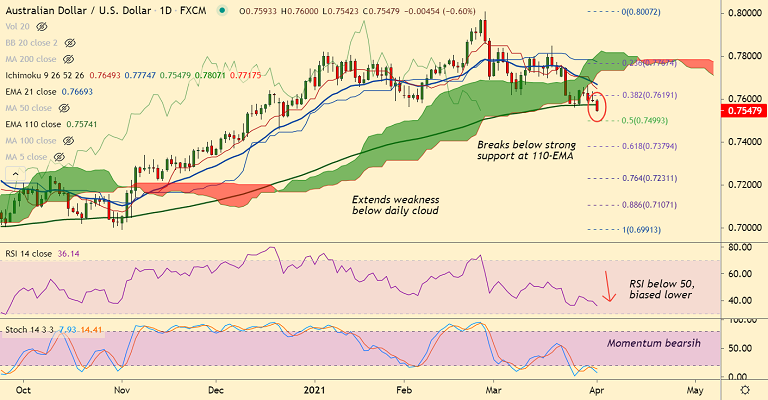

AUD/USD chart - Trading View

AUD/USD Spot Analysis:

AUD/USD was trading 0.34% lower on the day at 0.7567 at around 04:40 GMT, bias lower.

Session high/ low: 0.7600/ 0.7542

Previous session's high/low: 0.7636/ 0.7588

Data Released:

China Caixin Manufacturing PMI came in as 50.6 versus 51.3 forecasts and 50.9 prior.

Australia Trade Balance for February eased from 9700M forecast to 7529M, versus 10142M prior

Australia Retail Sales shrank less than initial estimations of -1.1% to -0.8% during the stated period

Australia Imports rose beyond -2.0% previous readouts to +5.0% and the Exports dropped from 6.0% to -1.0% for the reported period.

Australia AiG Performance of Mfg Index for March, 59.9 versus 58.8 prior

Technical Analysis:

- GMMA indicator shows minor trend has turned bearish, while major trend is turning bearish

- Momentum is strongly bearish. Stochs and RSI are sharply bearish. RSI is below 50 mark

- Price action is extending weakness below daily cloud and has broken below 55-EMA support

- Gravestone doji formation on the previous weeks candle adds to the bearish bias.

Summary: The Australian dollar depressed after unexpected weakness in China Caixin PMI data, in contrast to upbeat official readings published earlier in the week. Also adding to weakness in the major was broad-based US dollar’s strength and sluggish sentiment. Scope for test of 50% Fib at 0.75.