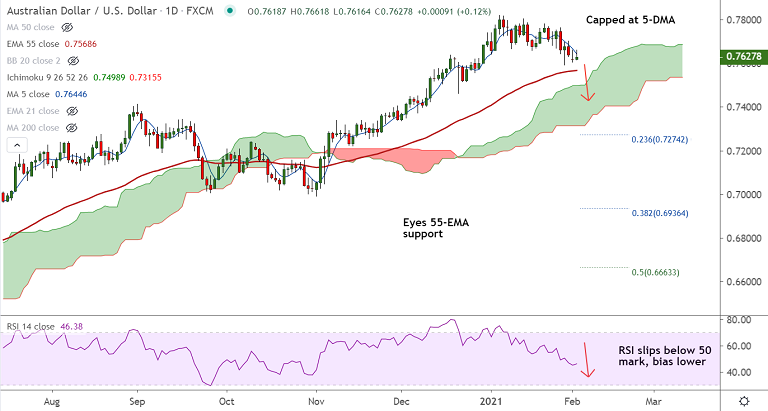

AUD/USD chart - Trading View

The Reserve Bank of Australia (RBA) matched wide market expectations on the rate change, keeping it unchanged at 0.10%.

The RBA left its three-year bond yield target unchanged at 0.10%. However, the board decided to purchase an additional $100 billion of bonds from mid-April.

The Australian dollar met fresh supply after RBA statements suggested that it doesn't see conditions for CPI rise met until 2024.

The pair erased early gains and was trading lagely muted at 0.7615 at around 06:30 GMT. Gravestone Doji formation on Monday's candle dents upside potential.

The pair is extending break below 21-EMA and recovery attempts remain capped below 5-DMA.

Oscillators are biased lower, volatility is rising and short-term moving averages on the GMMA indicator have turned bearish.

Bears now target 55-EMA support at 0.756. Break below will drag the pair lower to test 38.2% Fib retracement at 0.7503.

On the flipside, the pair finds strong resistance at 21-EMA at 0.7673. Retrace above will negate bearish bias.