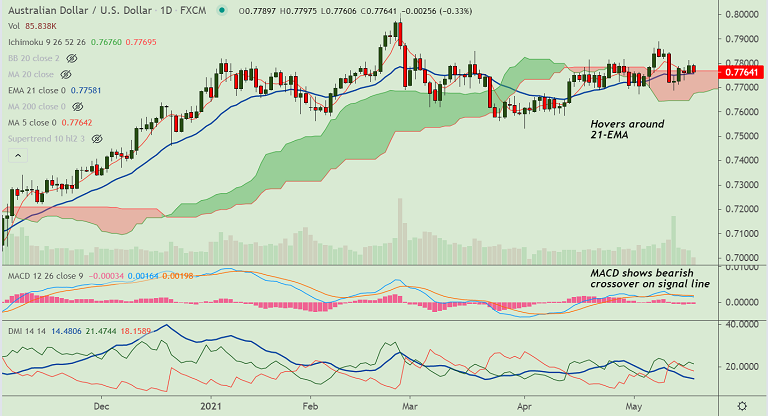

AUD/USD chart - Trading View

AUD/USD was trading 0.32% lower on the day at 0.7764 at around 07:50 GMT.

Pre-FOMC minutes caution trading weighs on the higher-yielding aussie while the US dollar attempts a tepid bounce.

The major eroded a major part of the overnight strong gains and has slipped lower to test 21-EMA support at 0.7758.

Technical indicators do not provide a clear directional bias. Major and minor trend are neutral as evidenced by GMMA indicator.

Investors likely to refrain from placing any aggressive bets, will wait on the sidelines ahead of the FOMC meeting minutes.

21-EMA is strong support at 0.7758. Break below 21-EMA will see dip till 55-EMA at 0.7726.