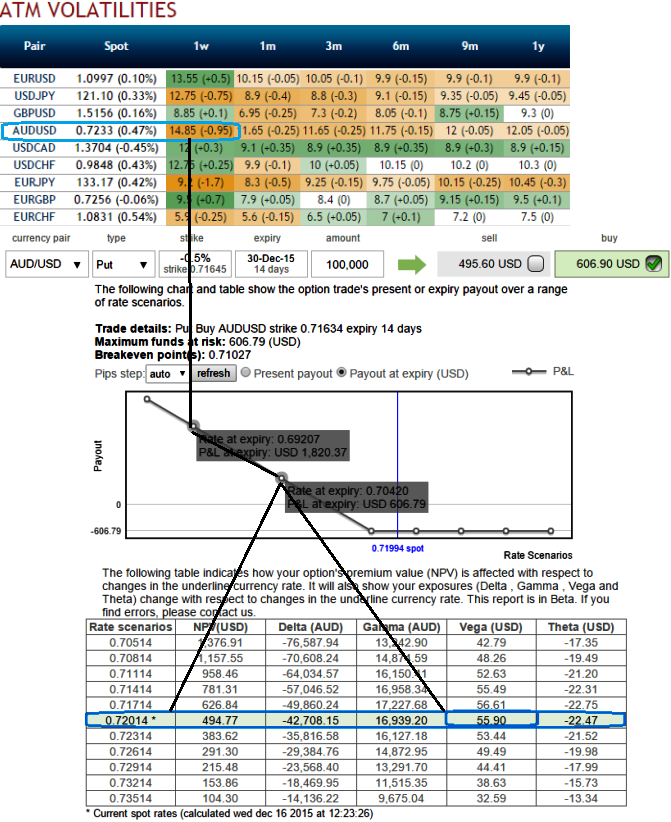

As you can make out from the diagram the implied volatility of at the money contracts of AUDUSD pair has been spiking up crazy, highest among G20 currency segment (almost close to 15% for this week). If IV is high, it means the market thinks the price has potential for large movement in either direction.

At current spot FX ticking at 0.7290, Selling 2D out of the money call option is recommended to reduce the cost of hedging by financing long position in buying 2W out of the money vega put options as the selling indications are piling up on daily and weekly graphs.

So, buy 2W (-0.5%) out of the money vega put options and short 2D (1%) out of the money call option.

Here, by employing 2D OTM calls writing in our strategy is to beat both higher implied volatilities and delta risk reversals.

In this instance, let's suppose in 2 days' time AUDUSD moves to 0.7280 from current levels of 0.7205 (75 pips i.e 1%) calls that we've written here would be at the money.

But, it is in competitive advantage as our OTM put instrument becomes in the money even if dips below 0.7170 (hardly 35 pips) and its Delta increased to -0.52 from -0.45, Gamma is responsible for this change. Gamma controls the Delta that decides the change in Delta based on a 1-pip change in the underlying value.

As shown in the diagram, the Vega of a long put option position is 56 USD and IV is at 15%, if it increases or decreases by 15%, the option's premium will likely increase or decrease by 840 USD, respectively.

In the FX derivatives market, where such contracts trade, is very deep, both in terms of the volume of options traded and the size of the underlying notional of the contracts. Developing the IV approach using call options but, due to the put-call parity.

FxWirePro: AUD/USD hedging arrangements ahead of highest IV among G20 space – vega spreads to deal higher IV

Wednesday, December 16, 2015 7:02 AM UTC

Editor's Picks

- Market Data

Most Popular