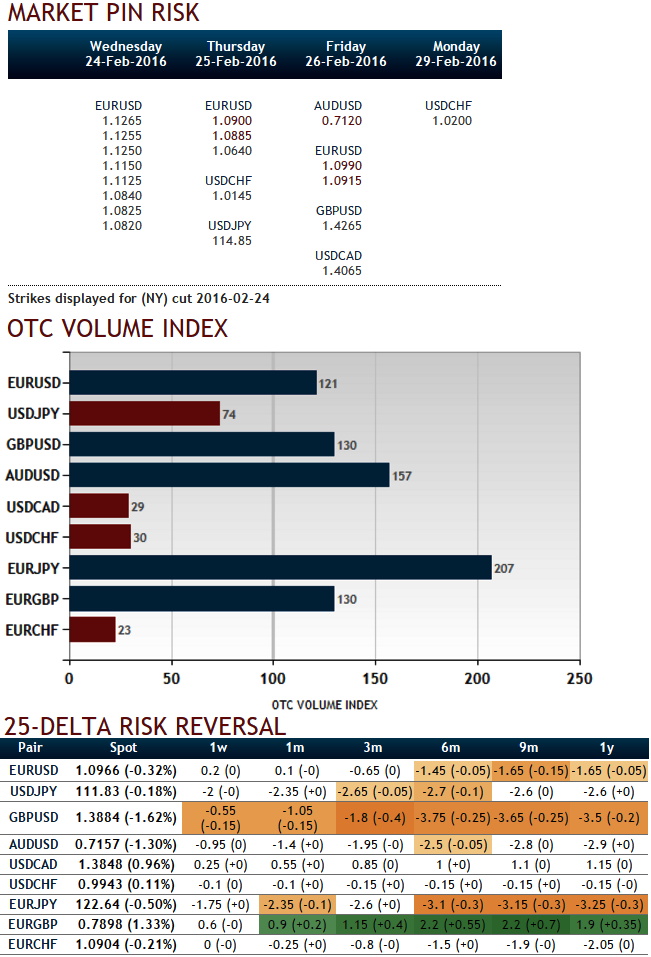

Please have a look on AUDUSD's option market pin risk report, the contracts of strikes around 0.7120 are highly liquid, it shows in OTC FX options market, large number of options expiring in the next 5 days. Red strikes indicate sizeable open interest close to the current spot FX rate.

While, risk reversal still favours bears even in long run, and ATM implied volatilities are remained above 12.5% consistently over the period.

Positions of significant size in the forex options market can have an influence on the underlying forex spot rate.

FX Options strikes in large notional amounts, when close to the current spot level, can have a magnetic effect on spot prices.

That is, spot may trend around those strikes as the holders of the options will aggressively hedge the underlying delta.

Hence, with spot FX at 0.7176, it is better to short 1W (2%) In the money put with positive theta,

Long in 2W at the money -0.49 delta put and one more long in 1M (1%) out of the money -0.31 delta put. The spread is constructed in the ratio 2:1 with reduced cost by short side.

Rationale: As we capitalize on the market pin risk, we've chosen (1%) ITM shorts (i.e strikes at 0.7105), even if it dips upto 0.7120 (market pin risks) in next 5 days, these short contracts expire worthless. ATM and OTM longs capitalizing on consistent higher IVS and bearish biased risk reversals.

FxWirePro: AUD/USD highest OTC activities among G10 - deploy PRBS to hedge, shorts on IVs and longs on sizeable OI at 0.7120

Thursday, February 25, 2016 8:30 AM UTC

Editor's Picks

- Market Data

Most Popular