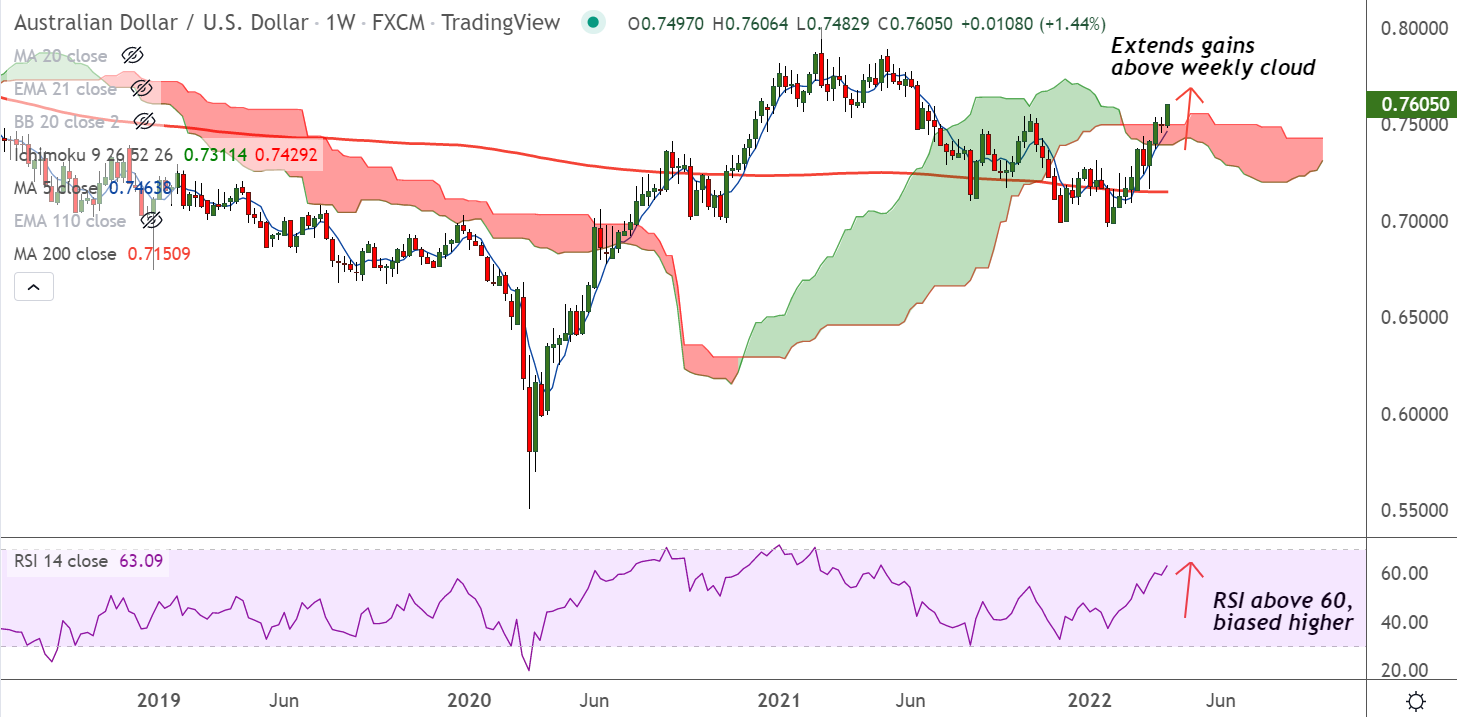

Chart - Courtesy Trading View

AUD/USD spiked higher to test fresh ten-month high above 0.76 handle, bias remains bullish.

The Reserve Bank of Australia (RBA) has kept the interest unchanged at 0.1% as widely expected.

Aussie buoyed after the RBA monetary policy statement read that the Australian economy remains resilient and spending is picking up following the omicron setback.

The central bank noted that inflation has picked up and a further increase is expected. It forecast unemployment rate to fall to below 4 percent this year and to remain below 4 percent next year.

AUD/USD is extending break above the weekly cloud and is poised for further gains. Next major hurdle for the pair lies at 110-month EMA at 0.7631.

Major Support Levels:

S1: 0.7526 (5-DMA)

S2: 0.7506 (200H MA)

Major Resistance Levels:

R1: 0.7631 (110-month EMA)

R2: 0.7650 (Upper BB)

Summary: AUD/USD trades with a bullish bias. Scope for test of 0.7630 level (110-month EMA resistance). Further upside only on decisive break above.