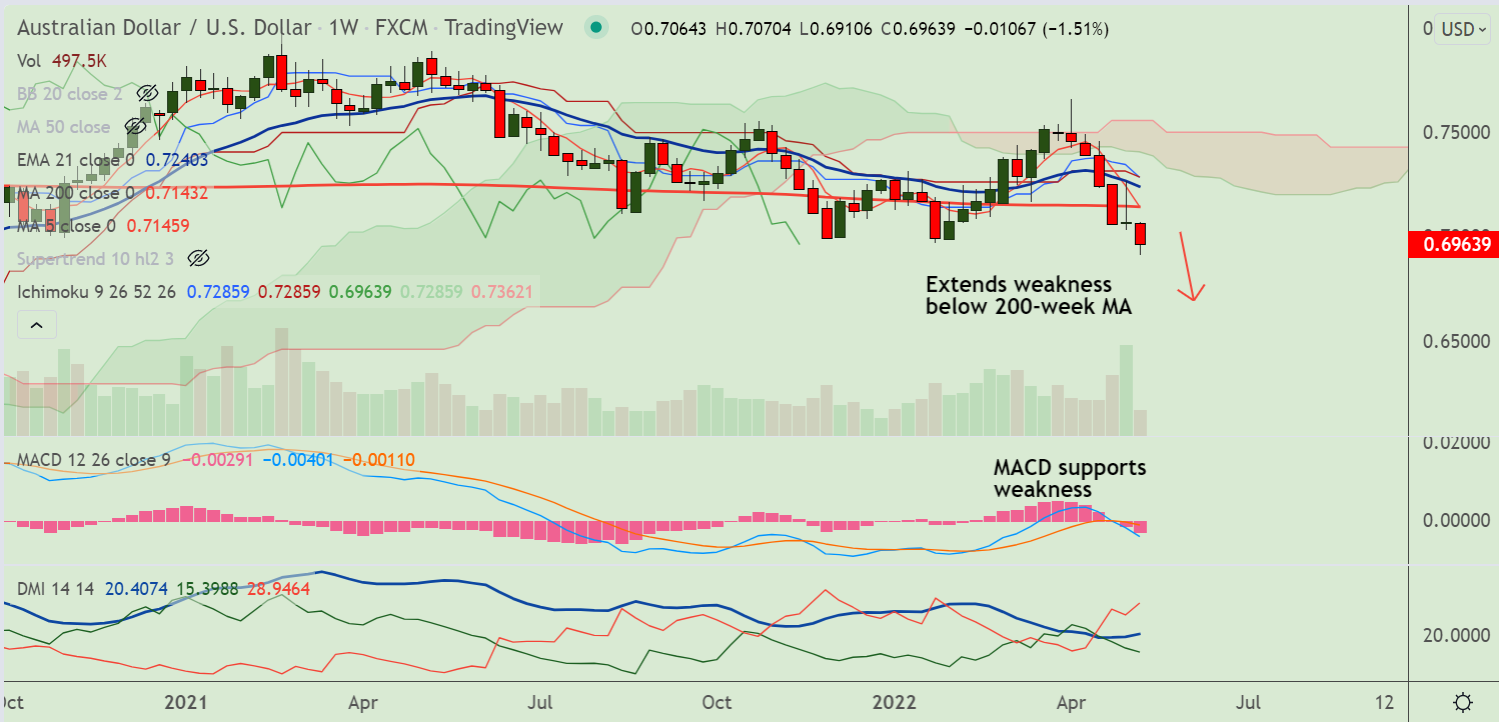

Chart - Courtesy Trading View

Spot Analysis:

AUD/USD was trading 0.13% higher on the day at 0.6958 at around 08:30 GMT

Previous Week's High/ Low: 0.7266/ 0.7029

Previous Session's High/ Low: 0.7070/ 0.6944

Fundamental Overview:

The US dollar remained on the defensive amid a softer tone around the US Treasury bond yields.

That said, scope for a more aggressive Fed tightening helped limit any deeper losses for the buck and kept a lid on any meaningful upside for the pair.

Strict COVID-19 lockdowns in China have been fueling fears about softening global growth and a possible recession.

Wednesday’s US CPI ex Food & Energy for April, expected 6.0% YoY versus 6.5% prior, will be crucial as the Fed’s 75 bps rate hike looms.

Technical Analysis:

- Major moving averages are trending lower and price action is below major moving averages

- Momentum is strongly bearish, Stochs and RSI are sharply lower

- ADX and MACD support downside in the pair

- Gravestone Doji formed on the previous week's candle dents upside

Major Support and Resistance Levels:

Support - 0.6884 (Lower BB), Resistance - 0.7090 (200H MA)

Summary: AUD/USD trades with a bearish bias. Recovery attempts lack traction. Scope for further weakness.