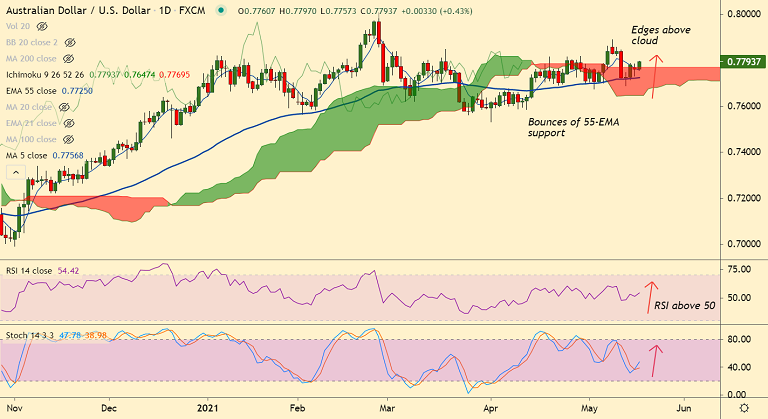

AUD/USD chart - Trading View

AUD/USD was trading just shy of 0.78 handle as the pair remains buoyed amid US dollar weakness and upbeat RBA minutes.

The Reserve Bank of Australia released the Minutes of the May Board meeting which keeps rate hike at bay until 2024.

The central bank left its key rates at 0.1% for a fifth straight meeting this month and reiterated it would not hike until actual inflation was within its 2-3% target band.

Minutes showed the RBA stands ready to alter bond buying, if needed, but not yield target. The Board believed wages would likely need to expand by "sustainably above 3%" to generate inflation.

Further, Australian Treasury Secretary Steven Kennedy offered optimistic remarks on the economic recovery while noting that the nation's economic recovery is stronger than in many other countries.

Market mood remains upbeat in Asia amid chatters over US mask mandate and vaccine patent waiver. Upbeat mood also favored the AUD/USD upside.

China’s NDRC said 'Australia should stop interfering in trade and investment'. China's comments amid the ongoing Aussie-China tussle failed to impair bulls.

Technical bias is turning bullish as the pair edges above 200H MA. Price action has bounced off 55-EMA with a Doji on the previous session's candle. Scope for upside resumption.