Chart - Courtesy Trading View

AUD/USD was trading 0.11% higher on the day at 0.6689 at around 04:45 GMT, slips lower from session highs at 0.6711.

China prints mixed data during early Wednesday, fails to provide support to the Aussie pair. Risks emanating from the latest fallouts of the SVB and Signature Bank also seem to challenge AUD/USD buyers.

Data released earlier today showed China’s Industrial Production rose to 2.4% during January-February period, missing expectations at 2.6% and 1.3% prior.

Further, the Retail Sales came inline with forecasts at 3.5% during the stated period compared to -1.8% prior.

Earlier in the day, the People’s Bank of China (PBOC) held its one-year benchmark rate, namely the one-year Medium-term Lending Facility (MLF) rate, unchanged at 2.75%.

Further, US Consumer Price Index (CPI) and CPI ex Food and Energy matched 6.0% and 5.5% YoY market forecasts, versus 6.4% and 5.6% respective previous readings.

On the other side, downbeat Australia Westpac Consumer Confidence for March and softer prints of the National Australia Bank’s sentiment data for February, published on Tuesday keep upside capped.

Focus now on US Retail Sales for February, expected -0.3% MoM versus 3.0% prior for intraday directions.

Thursday’s Australia jobs report for February and the Reserve Bank of Australia (RBA) Bulletin for the fourth quarter (Q4) will also be watched for influence on price action.

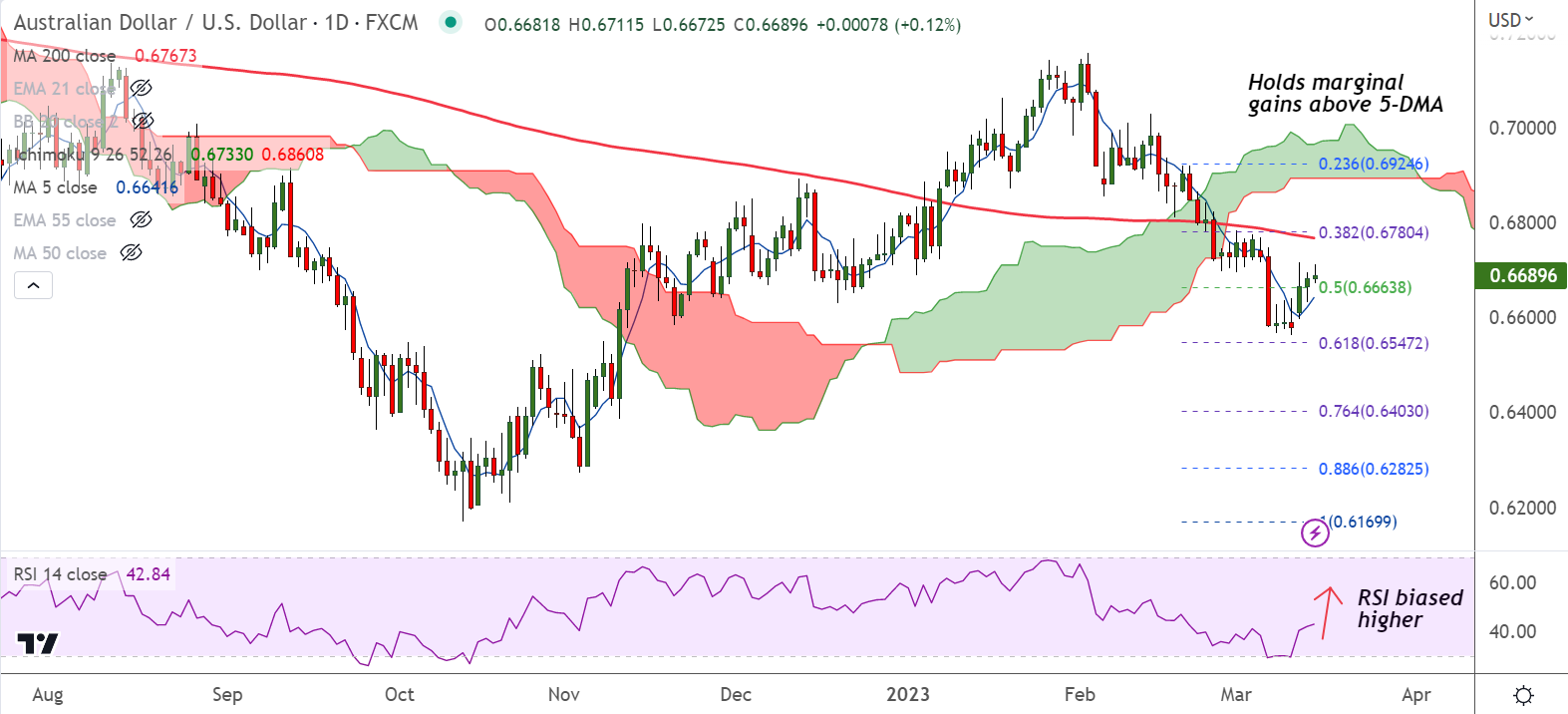

Technical Analysis:

- AUD/USD is extending gains for the 3rd straight session

- Stochs and RSI show bullish rollover from oversold levels

- MACD is on verge of bullish crossover on signal line

- Price action is above 200H MA and GMMA indicator is bullish on the intraday charts

Major Support Levels: 0.6659 (200H MA), 0.6641 (5-DMA)

Major Resistance Levels: 0.6732 (21-EMA), 0.6767 (200-DMA)

Summary: AUD/USD trades with a bullish bias, scope for further gains. Next bull target lies at 21-EMA at 0.6732.