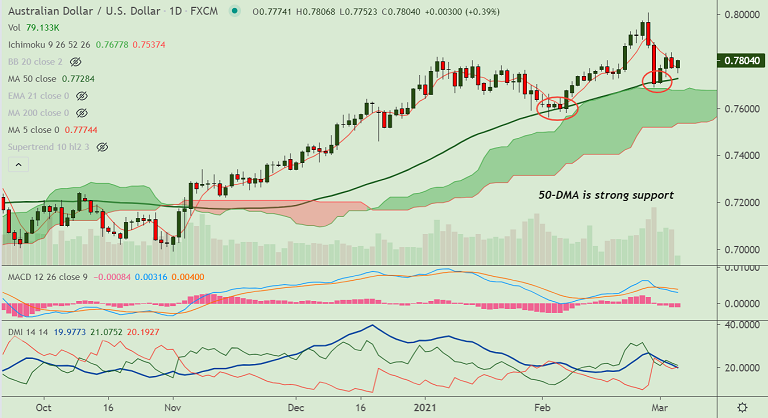

AUD/USD chart - Trading View

AUD/USD was trading 0.19% higher on the day at 0.7789 at around 04:00 GMT, outlook remains neutral.

Australian dollar failed to receive any boost from mixed Australian trade and retail sales data.

Australia’s Retail Sales missed expectation of 0.6% month on month and printed at 0.5% compared to 0.6 in the previous month.

Australia January balance of goods and services arrived at A$+10,142 mln versus 6,500M expected and 6,785 prior.

Details of the report showed Exports rose +6 pct MoM while Imports fell -2 pct MoM for the said period.

AUD/USD edged higher from session lows at 0.7752 and hit session highs at 0.7797. That said, further gains appear elusive as U.S. dollar gains strength.

Focus on U.S. weekly Jobless Claims and Q4 details for Non-farm Productivity and Unit Labor Cost along with Fed Chair Jerome Powell’s speech, at 17:05 GMT for impetus.

Any hint of reflation fears from the Fed chief will boost the bond bears and will help boost the market sentiment.