Chart - Courtesy Trading View

AUD/USD was trading 0.19% higher on the day at 0.6972 at around 06:45 GMT, after closing 1.11% higher in the previous session.

U.S. Federal Reserve Chairman Jerome Powell did not revert to a hawkish stance after strong jobs data. He said policymakers were open to shocks in either direction.

The not so hawkish Powell's comments sent dovish signals across markets, dragging the dollar index lower.

"The messaging seems quite balanced, with Powell reiterating the data dependence message," said analysts at ANZ.

On the other side, the Australian dollar jumped on Tuesday after Reserve Bank of Australia (RBA) hiked interest rates and said "further increases" would be needed, a more hawkish outlook than expected.

The central bank omitted its previous condition that policy was not on a "pre-set path", suggesting further rate rises were more likely than not.

The RBA raised rates by 25 basis points to a decade-high of 3.35%, and the rhetoric implied more than one more hike are to follow.

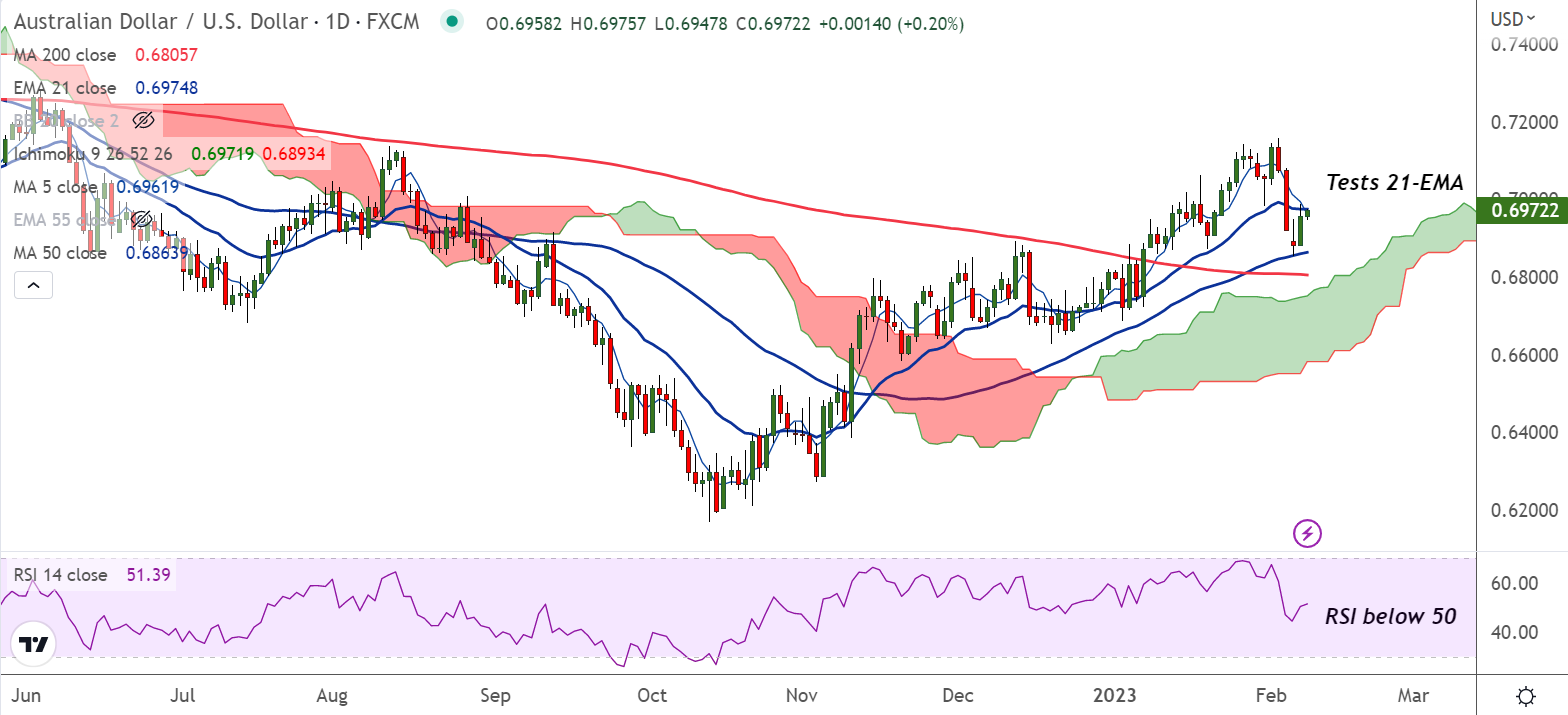

Support levels - 0.6869 (55-EMA), 0.6805 (200-DMA)

Resistance levels - 0.6975 (21-EMA), 0.7007 (20-DMA)

Summary: AUD/USD pullback after testing 200-week MA has held support at 55-EMA. The pair is extending bounce off 55-EMA support.

Major trend in the pair is bullish as evidenced by GMMA indicator. Price action is testing 21-EMA and decisive break above will see further gains.