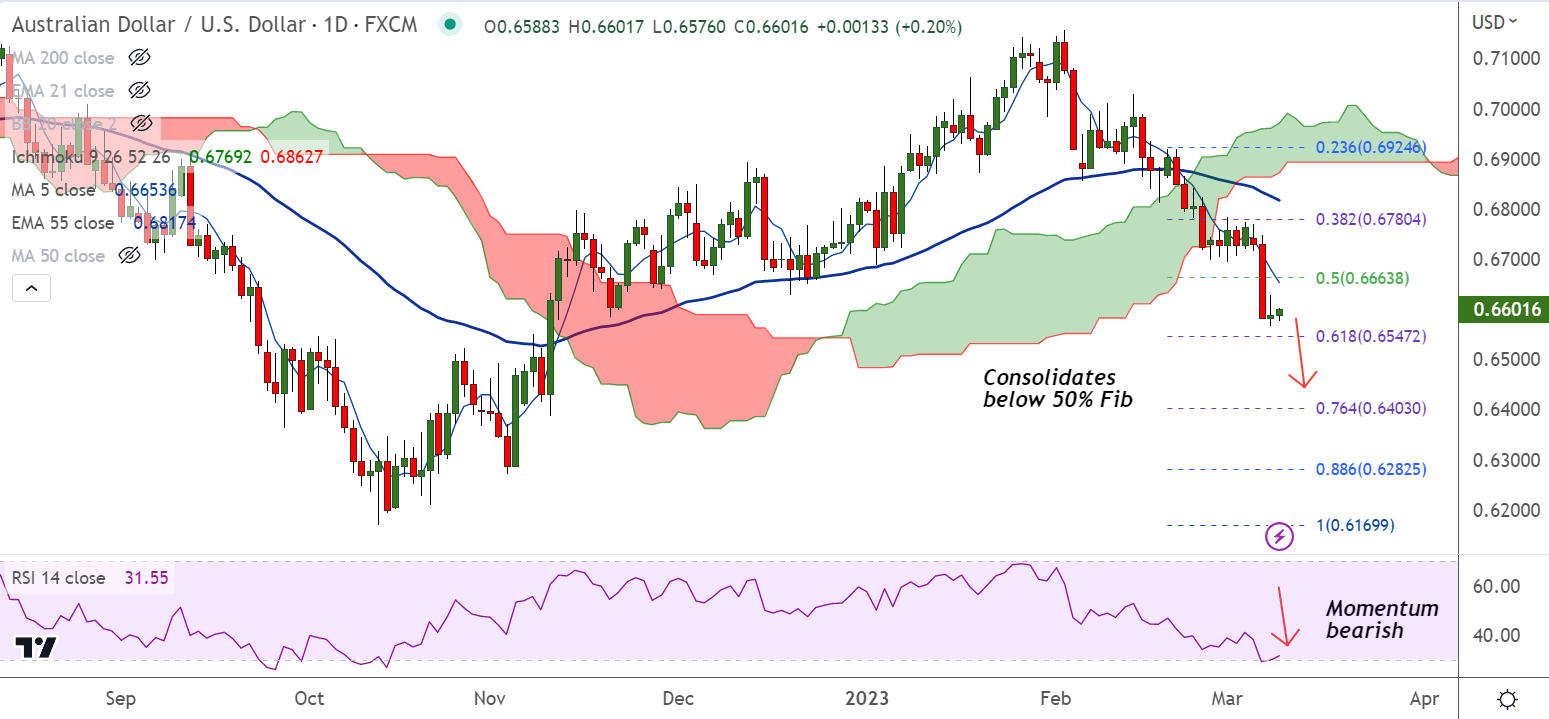

Chart - Courtesy Trading View

AUD/USD was trading 0.17% higher on the day at 0.6598 at around 04:45 GMT.

The pair is consolidating break below 50% Fib retracement, bias remains bearish.

China inflation numbers came in softer for February, but Aussie largely ignores data, holds marginal gains.

China’s headline Consumer Price Index (CPI) fell to 1.0% YoY versus 1.9% expected and 2.1% prior.

The Producer Price Index (PPI) also declined to -1.4% from -0.8% previous readings and -1.3% market consensus.

General risk-off mood and hawkish Federal Reserve (Fed) bets are likely to keep downside pressure.

US President Joe Biden proposed raising corporation tax from 21% to 28% in his latest budget guide ahead of Friday’s release.

A likely lack of acceptance and political chaos due to the said budget proposal seems to weigh on the market sentiment.

Focus on US Initial Jobless Claims for the week ended on March 03 along with the Challenger Job Cuts for February to offer more clues on Friday’s key NFP data.

Major Support Levels: 0.6547 (61.8% Fib), 0.6449 (Lower W BB)

Major Resistance Levels: 0.6654 (5-DMA), 0.6778 (200-DMA)

Summary: AUD/USD recovery lacks traction. Bias remains bearish and upticks could be used as opportunities to go short. Next major bear target is 61.8% Fib at 0.6547.