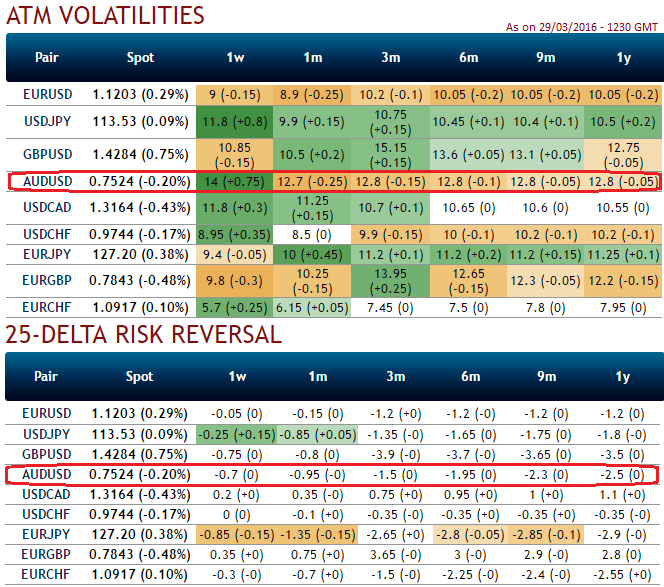

AUD/USD is currently the pair to perceive the highest implied vols among G20 currency space for 1w expiries (more than 14%).

Top ranked for 1y tenors as well in G20 space or any EM basket and same is the case with realized vols (see IV & risk reversal nutshell).

Volatility smiles most frequently show that traders are willing to pay higher implied volatility prices as the strike price grows aggressively out of the money.

Risk reversal numbers in both short and long term signals downside risks, extreme negativity has been build up upto next 12 months tenors.

However, the recent breakout above the .7380/.7440 resistance zone and medium term range highs has led to a deeper recovery phase which still appears incomplete.

While maintaining an impulsive, trending bias, the near term focus is on the .7600/.7700 resistance zone, which represents the breakdown from July 2015, as well as the 61.8% retracement of the decline from the May peak. But the pair should fall between 0.74-0.7650 by end of Q3'2016.

Proven one of the improved gamma buys of 2015, thanks to an outsized 12% decline in the currency and 10.25% recovery within last 3 months.

AUD/USD is still stuck in its 0.7000/0.7650 range despite showing little strength, mirroring the lack of direction in front-end AU-US rate spreads.

We think the spread could narrow from both sides over the next 3m, pushing AUD/USD lower. Our official forecast calls for two more cuts from the RBA in H2 2016 though there is a higher risk now that those cuts are delayed.