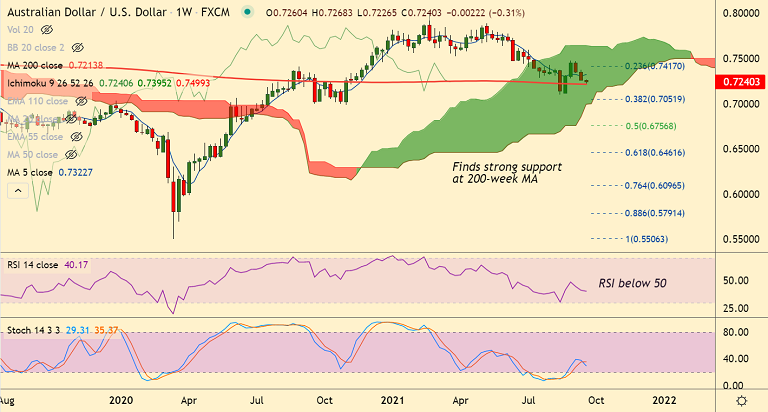

AUD/USD chart - Trading View

Spot Analysis:

AUD/USD was trading 0.37% lower on the day at 0.7235 at around 08:00 GMT.

Previous Week's High/ Low: 0.7375/ 0.7262

Previous Session's High/ Low: 0.7321/ 0.7262

Fundamental Overview:

China's retail giant Evergrande's default story is gaining traction and dampening the investors' sentiment, despite holiday-thinned trading.

Souring investor sentiment and caution ahead of U.S. Federal Reserve's monetary policy meeting is weighing on the pair.

Uncertainty over the US covid stimulus also weighs on the market sentiment.

Investors now wait for the latest FOMC monetary policy decision on Wednesday for clues on the asset tapering and interest rate hike timelines.

The central bank is expected to open discussions on reducing its monthly bond purchases, while tying any actual change to U.S. job growth in September and beyond.

Technical Analysis:

- AUD/USD is extending weakness for the third straight session

- MACD confirms bearish crossover on signal line, ADX supports downside

- GMMA indicator shows major and minor trend are strongly bearish on the intraday charts

- Recovery was rejected at daily cloud, Stochs and RSI are sharply lower

Major Support and Resistance Levels:

Support - 0.7213 (200-week MA), Resistance - 0.7287 (5-DMA)

Summary: AUD/USD pivotal at 200-week MA support. Break below will open downside. FOMC meeting will be watched for direction. Next major bear target lies at 38.2% Fib retracement at 0.7051.