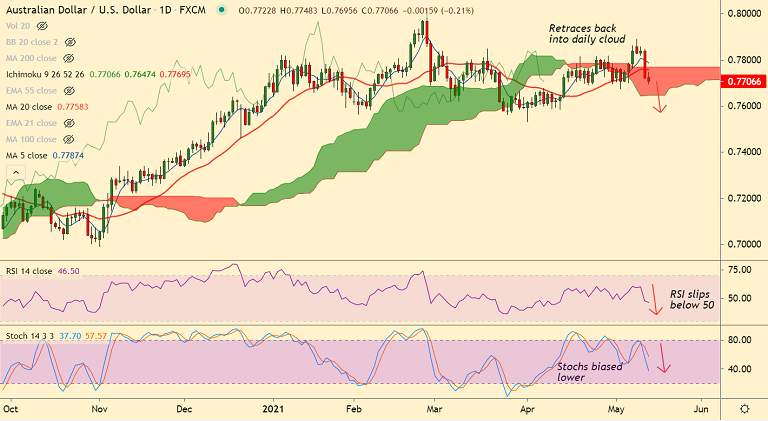

AUD/USD chart - Trading View

AUD/USD was trading 0.31% lower on the day at 0.7699 at around 08:45 GMT.

The pair is extending previous session's weakness and is set for further downside.

Minor recovery attempts were rejected at 21-EMA, raising scope for further weakness.

The major dived lower overnight after higher than expected US inflation data, which posted the biggest monthly increase in thirteen years boosted the U.S. dollar across the board.

Technical indicators have turned bearish. Stochs and RSI are biased lower. MACD shows bearish crossover on signal line.

GMMA indicator shows major trend is neutral, while minor trend has turned bearish. Further bearish divergence on Stochs adds to the bearish bias.

Price action hovers around 55-EMA and is on track to test 110-EMA at 0.7640. Break below 110-EMA will open downside.