The Aussie plummeted today after the mixed housing related data. AUDUSD is dropped a little at 0.7465 after the Australian Bureau of Statistics earlier reported that building approvals dropped 12.6% in October, confounding expectations for a 1.5% gain.

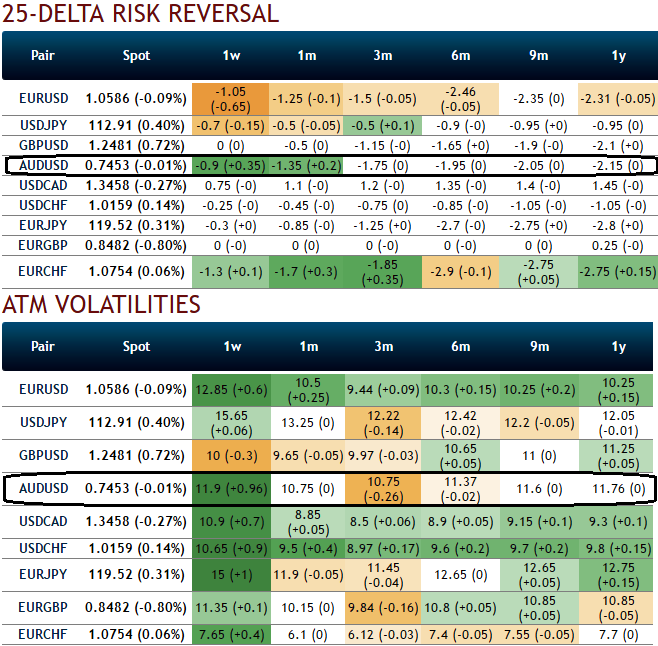

Let’s just have a glance over OTC sentiments of AUD’s ATM contracts, from positive risk reversal flashes you can possibly make out hedging functions for short term upside risks in the underlying spot FX of AUDUSD and but bearish risk sentiments in long run remains intact, while the spike in 1w IV skews also signifies the hedging interests for upside risks.

While rising negative risk reversal flashes are still signaling mounting downside risks. Considering above fundamental development that causes volatility in FX markets, we think the opportunity lies in writing an ITM put or OTM call while formulating in any speculative or hedging option strategies while capitalizing on AUDUSD's fluctuation.

Because ITM options would usually be the most expensive, thus, buyers end up paying the most and the sellers receive the most. Their premium is mostly made up of intrinsic value so they are relatively immune to Vega and Theta.

Hence, trade an ITM put option if you want to minimize the risk of Vega and Theta.

They are an excellent tool when you have a strong view on the market because deep ITM options have the highest Delta. They will behave more like a position in the underlying. But if the market moves against you, the Delta declines so the loss becomes smaller. As expiry approaches, the Delta increases.

On the flip side, OTM options would be the cheapest but they rely solely on extrinsic value and have a low Delta, Theta, and Vega. A move towards the ATM territory increases the Vega, Gamma, and Delta which boosts premium. However, Theta (time decay) also increases especially as expiry approaches. Hence, OTM shorts in calls in such scenario are most suitable for speculation.

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data