- The pair accelerated its decline following the Fed's yellen statement, reaching a daily low of 0.7067 before recovering towards 0.7125.

- Further upside is expected to be limited as the pair finds strong resistance at 0.7125 which should limit upside and bring a decline towards lower levels.

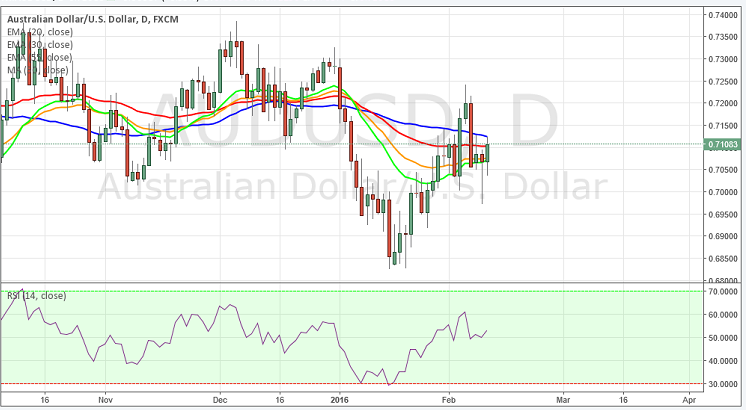

- Technically in the 4 hours chart, the pair is capped by 50 DMA, whilst the RSI heading south at 47.

- To the upside, the strong resistance can be seen at 0.7176, a break above this level would take the pair towards next resistance level at 0.7242.

- To the downside immediate support can be seen at 0.7043, a break below this level will open the door towards next level at 0.7000.

Recommendation: Go short around 0.7125, targets 0.7070, 0.6700, SL 0.7200

Resistance Levels

R1: 0.7125 (50-DMA)

R2: 0.7176 (61.8% Retracement level)

R3: 0.7242 (Feb 4th high)

Support Levels

S1: 0.7043 (38.2% Retracement level)

S2: 0.7000 (Psychological levels)

S3: 0.6960 (Feb 3rd high)