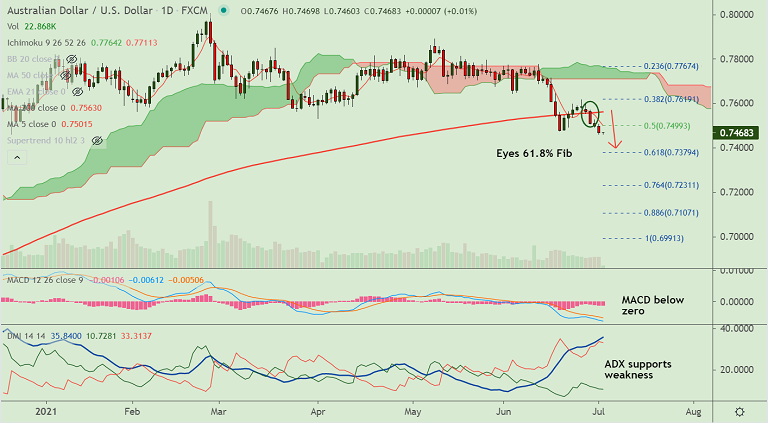

AUD/USD chart - Trading View

Spot Analysis:

AUD/USD was trading largely rangebound on the day at 0.7466 at around 05:00 GMT.

Previous Week's High/ Low: 0.7616/ 0.7477

Previous Session's High/ Low: 0.7507/ 0.7460

Fundamental Overview:

The major remains depressed by coronavirus (COVID-19) woes in Australia and cautious market mood ahead of the US Nonfarm Payrolls (NFP).

U.S. NFP is expected to rise from 559K to 690K in June. Markets expect US unemployment rate to drop from 5.8% to 5.6%.

Should the jobs report keep portraying strong recovery in the US labor conditions, the push for Fed’s monetary policy adjustments will be stronger and favor the USD bulls.

Technical Analysis:

- AUD/USD is extending break below 200-DMA

- MACD and ADX support weakness in the pair

- Momentum is strongly bearish, Stochs and RSI are sharply lower

- GMMA indicator shows major and minor trend have turned bearish on the intraday charts

Major Support and Resistance Levels:

Support - 0.7449 (55-week EMA), 0.7405 (Lower BB), 0.7379 (61.8% Fib)

Resistance - 0.75 (5-DMA and 50% Fib), 0.7563 (200-DMA), 0.7619 (38.2% Fib)

Summary: AUD/USD rangebound ahead of key US payrolls data. The major trades with a bearish technical bias. Break below 200-DMA has reinforced weakness in the pair. Scope for test of 61.8% Fib at 0.7379.