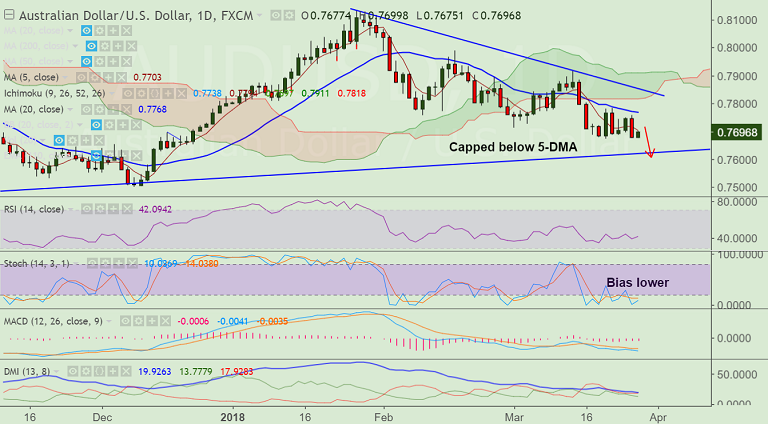

- AUD/USD extended its sharp retracement slide below daily cloud on Tuesday's trade.

- Minor recovery attempts in the pair today are seen capped at 0.77 handle, bias remains bearish.

- Technical indicators are tilted towards the downside, with RSI below 50 and MACD well below zero levels.

- Strong US Dollar rebound, led by receding fears of a US-China trade war will keep pressure on the major.

- On the data front US GDP and home sales will be in focus for further impetus.

- On the downside, we see scope for test of major trendline support at 0.7620. Break below will see further downside.

- On the flipside, breakout above 5-DMA will see test of 20-DMA at 0.7768. Violation at 20-DMA invalidates bearish bias.

Support levels - 0.7675 (March 27 low), 0.7620 (trendline), 0.76

Resistance levels - 0.7704 (5-DMA), 0.7768 (20-DMA), 0.7806 (200-DMA)

Recommendation: Good to go short on rallies around 0.77/ 0.7710, SL: 0.7770, TP: 0.7675/ 0.7620/ 0.76.

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -33.212 (Neutral), while Hourly USD Spot Index was at -66.7899 (Neutral) at 0430 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.