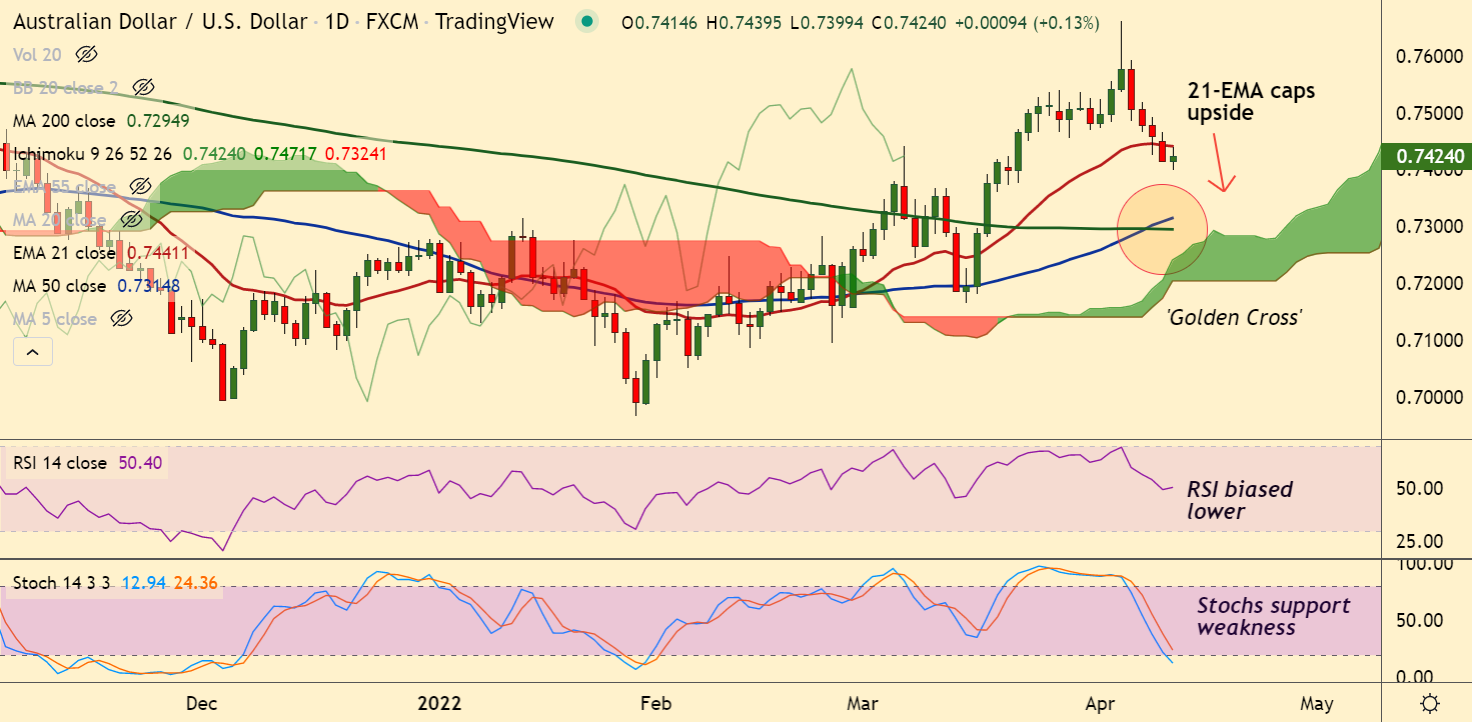

Chart - Courtesy Trading View

AUD/USD was trading 0.22% higher on the day at 0.7430 at around 07:15 GMT.

The pair has snapped a 4-day downside and edged higher, but recovery attempts lack traction.

Upside remains capped at 21-EMA, technical indicators support weakness in the pair.

Uncertainty regarding the release of the US Consumer Price Index (CPI) data later in the NY session keep investors wary.

The yearly US Consumer Price Index (CPI) is expected to print at 8.5%, much higher than the prior figure of 7.9%.

Core Consumer Price Index will likely increase by 0.47% in March, taking the year-on-year inflation rate higher by 20 basis points to 6.6%.

Higher US inflation print will force the Fed for a more aggressive tightening of monetary policy. The Fed has already announced seven interest rate hikes this year.

Stronger US dollar is likely to keep downside pressure in the pair. Decisive breakout above 20-DMA could change near-term dynamics.

Major trend remains bullish. Near-term weakness will see dip till 55-EMA at 0.7349. Break below finds major support at 200-DMA at 0.7294.