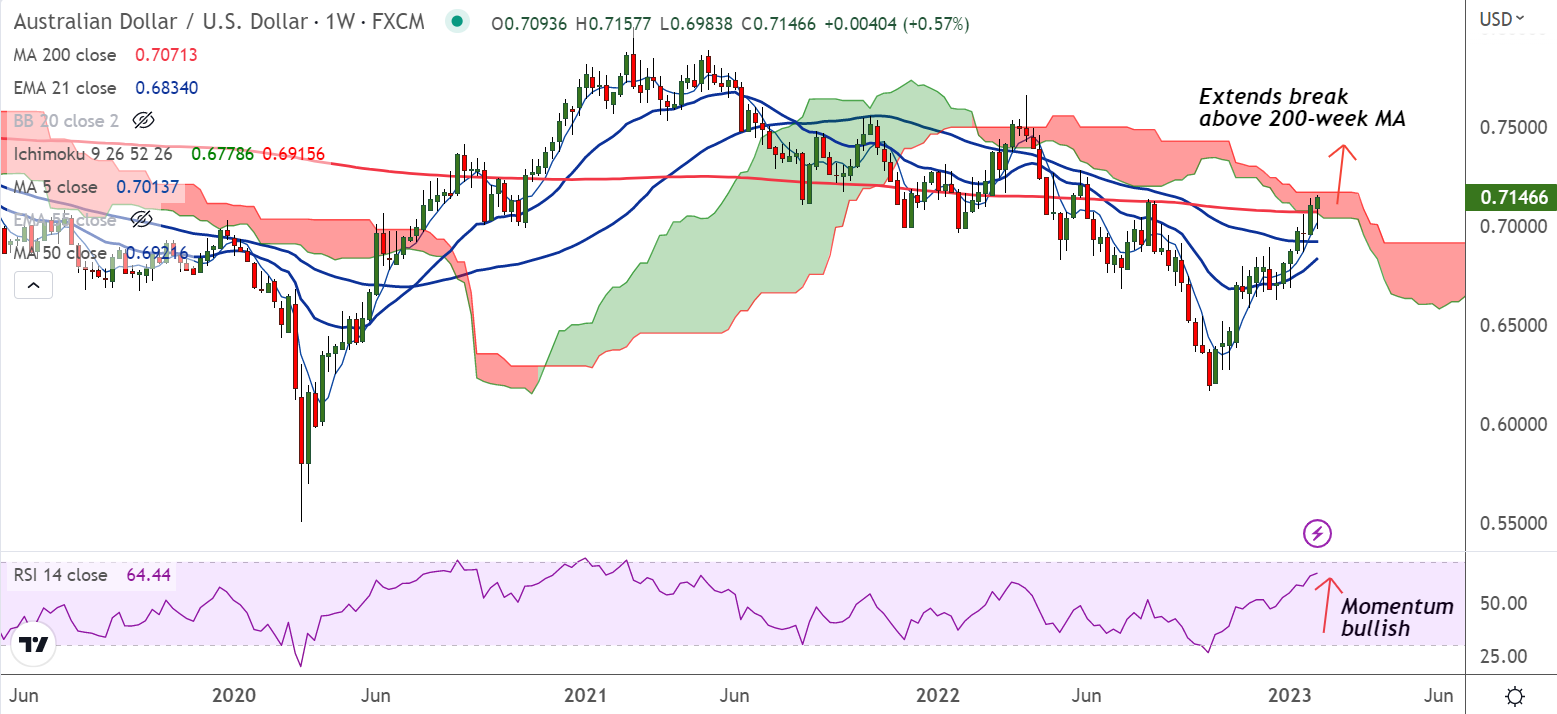

Chart - Courtesy Trading View

AUD/USD was trading 0.20% higher on the day at 0.7148 at around 04:40 GMT, after closing 1.13% higher in the previous session.

The Federal Reserve's dovish rate hike along with firmer prints of Australia housing data favor buyers in the pair.

The US dollar slipped across the board as markets bet that a U.S. economic slowdown will force the Fed into reversing its hawkish stance this year.

The weakness ensued despite the Fed interest rate hike as expected, and said that it plans to keep raising interest rates to curb elevated inflation.

On the other side, Australia’s Building Permits rose 18.5% MoM and improved to -3.8% YoY in December versus -9.0% and -15.1% respective priors.

Major focus now on US January’s nonfarm payrolls report, due on Friday for more signs of cooling in the jobs market and further direction.

Technical Analysis:

- GMMA indicator shows major and minor trend are bullish

- Momentum is bullish and volatility is high

- MACD and ADX support upside in the pair

- The pair is extending break above 200-week MA

Major Support Levels:

S1: 0.7100 (5-DMA)

S2: 0.7071 (200-week MA)

Major Resistance Levels:

R1: 0.7171 (Weekly cloud top)

R2: 0.7196 (Upper W BB)

Summary: AUD/USD was trading with a bullish technical bias. The pair is on track to test weekly cloud top at 0.7171, break above weekly cloud will propel the pair higher.