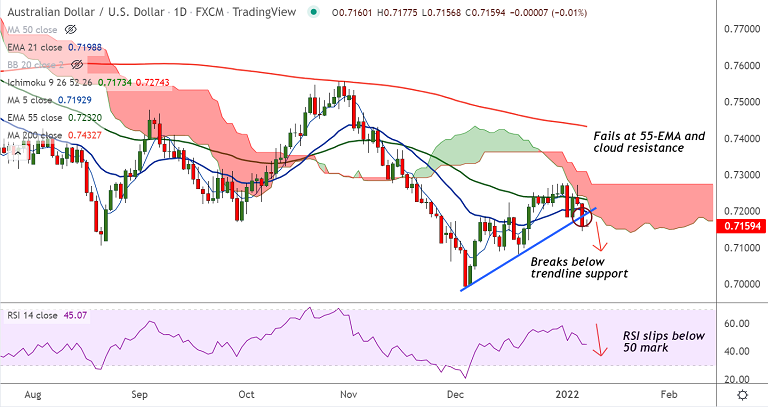

Chart - Courtesy Trading View

Technical Analysis: Bias Bearish

GMMA Indicator

- Major and minor trend are strongly bearish on the daily charts

Ichimoku Analysis

- Price action is extending weakness after rejection at daily cloud

Oscillators

- Stochs and RSI show bearish momentum

- RSI has slipped below 50 mark

Bollinger Bands

- Bollinger bands are spread wide apart and show high volatility

Major Support Levels: 0.71, 0.7091 (Lower BB), 0.7051 (38.2% Fib)

Major Resistance Levels: 0.7172 (200-week MA), 0.7192 (converged 5 and 20 MAs), 0.72

Summary: AUD/USD trades with a bearish bias. The pair has slipped lower from session highs at 0.7177 and is on track for further downside. Scope for test of 38.2% Fib.