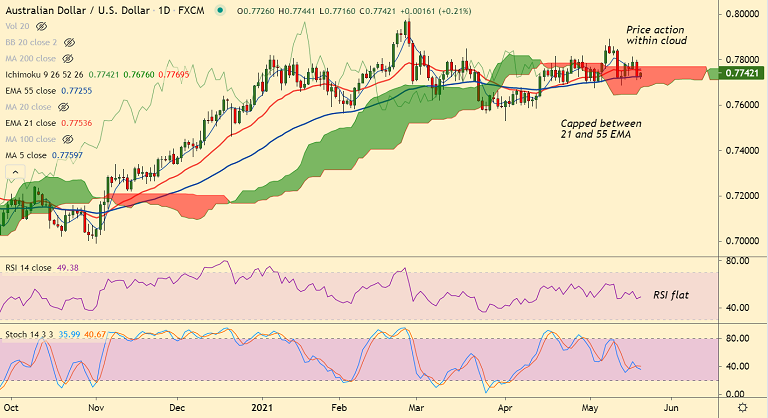

AUD/USD chart - Trading View

AUD/USD was trading 0.16% higher on the day at 0.7738 at around 04:15 GMT, outlook neutral.

The Australian dollar remains depressed on mixed Australia jobs and cautious market mood.

Data released earlier on Thursday showed Australia’s headline Employment Change missed forecasts with -30.6K versus +15K forecast and 70.7K prior.

However, the Unemployment rate printed at 5.5% level beating expectations at 5.6% and similar previous readouts.

Further, Australia Consumer Inflation Expectations for May eased below 3.6% market consensus to 3.5%, versus 3.2% prior.

Also, the People’s Bank of China (PBOC) matched the wide market forecast and kept its benchmark rate at 3.85%. The five-year LPR was also left unchanged at 4.65% in May.

Major Support Levels:

S1: 0.7725 (55-EMA)

S2: 0.7687 (Lower BB)

S3: 0.7651 (110-EMA)

Major Resistance Levels:

R1: 0.7753 (21-EMA)

R2: 0.7769 (Cloud top)

R3: 0.7844 (Upper BB)

Summary: AUD/USD was trading rangebound between 21 and 55-EMAs. Daily trend as evidenced by GMMA indicator is neutral. That said, major trend on the weekly charts is bullish. Bounce off 55-EMA will see upside resumption. However, break below 55-EMA finds next major support at 110-EMA at 0.7651. Violation at 110-EMA will change near-term dynamics.