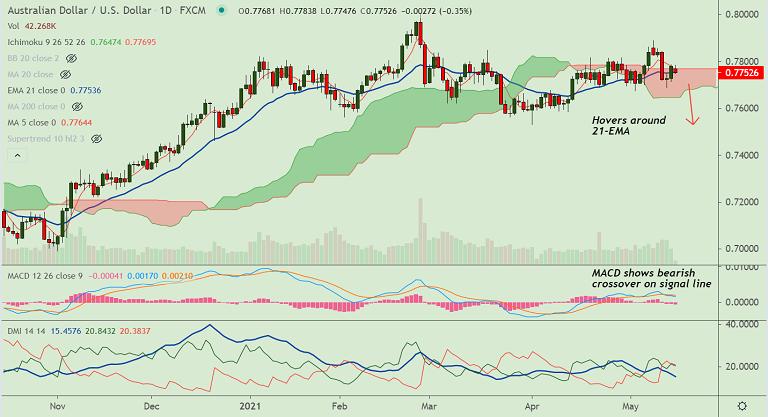

AUD/USD chart - Trading View

AUD/USD was trading 0.35% lower on the day at 0.7752 at around 04:25 GMT, outlook neutral.

The pair snapped 2-days of upside and remains depressed after mixed China data dump earlier today.

China Retail Sales slip beneath 34.2% prior and 24.9% forecast to 17.7% YoY whereas Industrial Production matches 9.8% market consensus versus 14.1% previous readouts.

Geopolitical tussles in the Middle East and fears of escalating Aussie-China tension weigh on the antipodeans.

Covid headlines likely to influence price moces. Focus also on RBA meeting minutes for impetus.

Major Support Levels:

S1: 0.7722 (55-DMA)

S2: 0.7679 (Lower BB)

S3: 0.7645 (110-EMA)

Major Resistance Levels:

R1: 0.7764 (5-DMA)

R2: 0.78 (Upper BB)

R3: 0.7890 (May 10th high)

Summary: AUD/USD pauses upside at cloud top. Recovery attempts rejected at 200H MA. Poor China data and risk-off market sentiment dents antipodeans. Scope for retest of 55-EMA at 0.7722. Major weakness only below 55-EMA. Decisive breakout above daily cloud will see upside resumption.