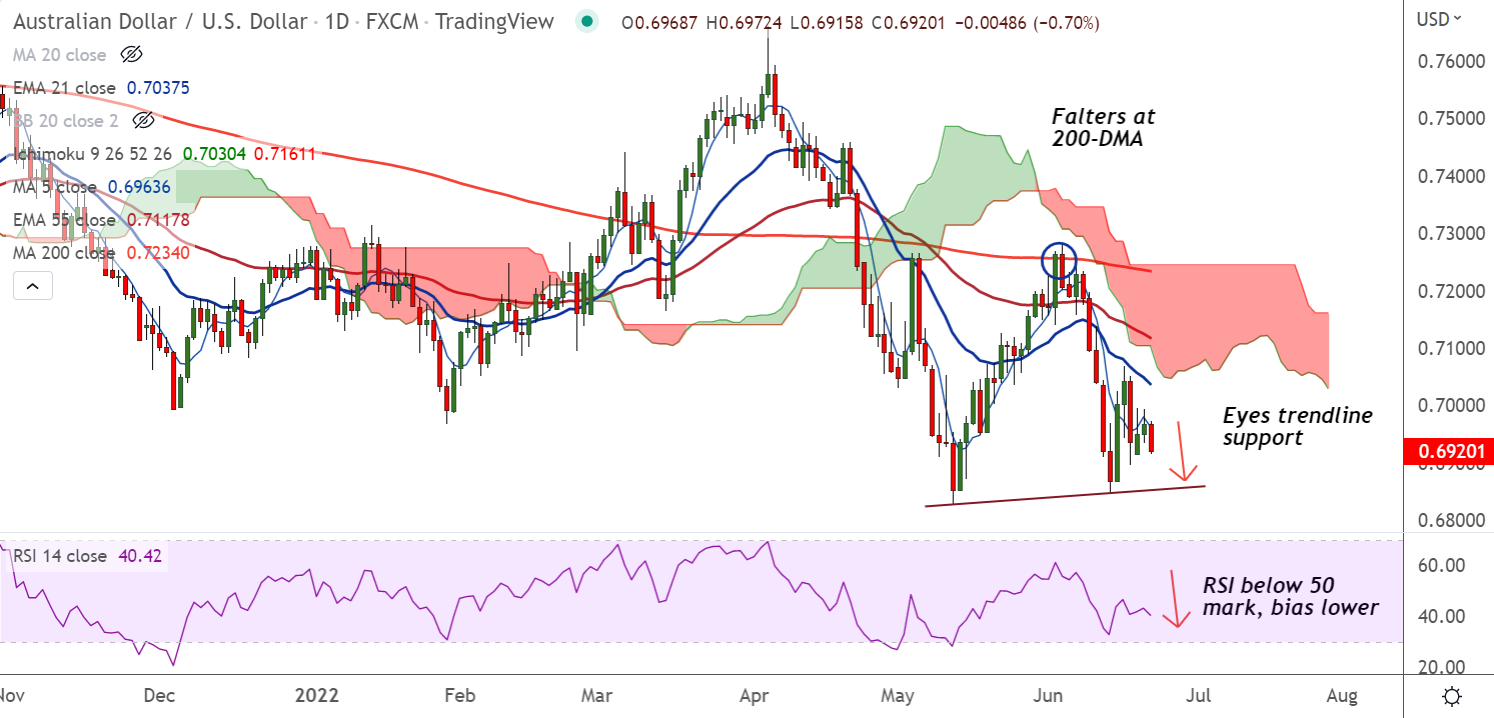

Chart - Courtesy Trading View

AUD/USD was trading 0.73% lower on the day at 0.6917 at around 05:15 GMT.

The major has snapped two-day uptrend and is extending weakness despite positive RBA minutes.

RBA minutes from the June monetary policy showed that the Australian economy doesn’t see any signs of recession on the current horizon.

Minutes showed the household spending is resilient despite depreciated paychecks due to higher price pressures.

According to the minutes, the jobless rate is going to remain untouched while fixing the inflation mess.

On the other side, negative market sentiment prevails as investors remain uncertain over Federal Reserve (Fed) chair Jerome Powell’s testimony.

Powell is expected to suggest bringing in more restrictive measures to contain the soaring inflation and on injecting liquidity into the economy.

Technical bias for the pair remains bearish. GMMA indicator shows major and minor trend are bearish. Scope for test of trendline support at 0.6855.