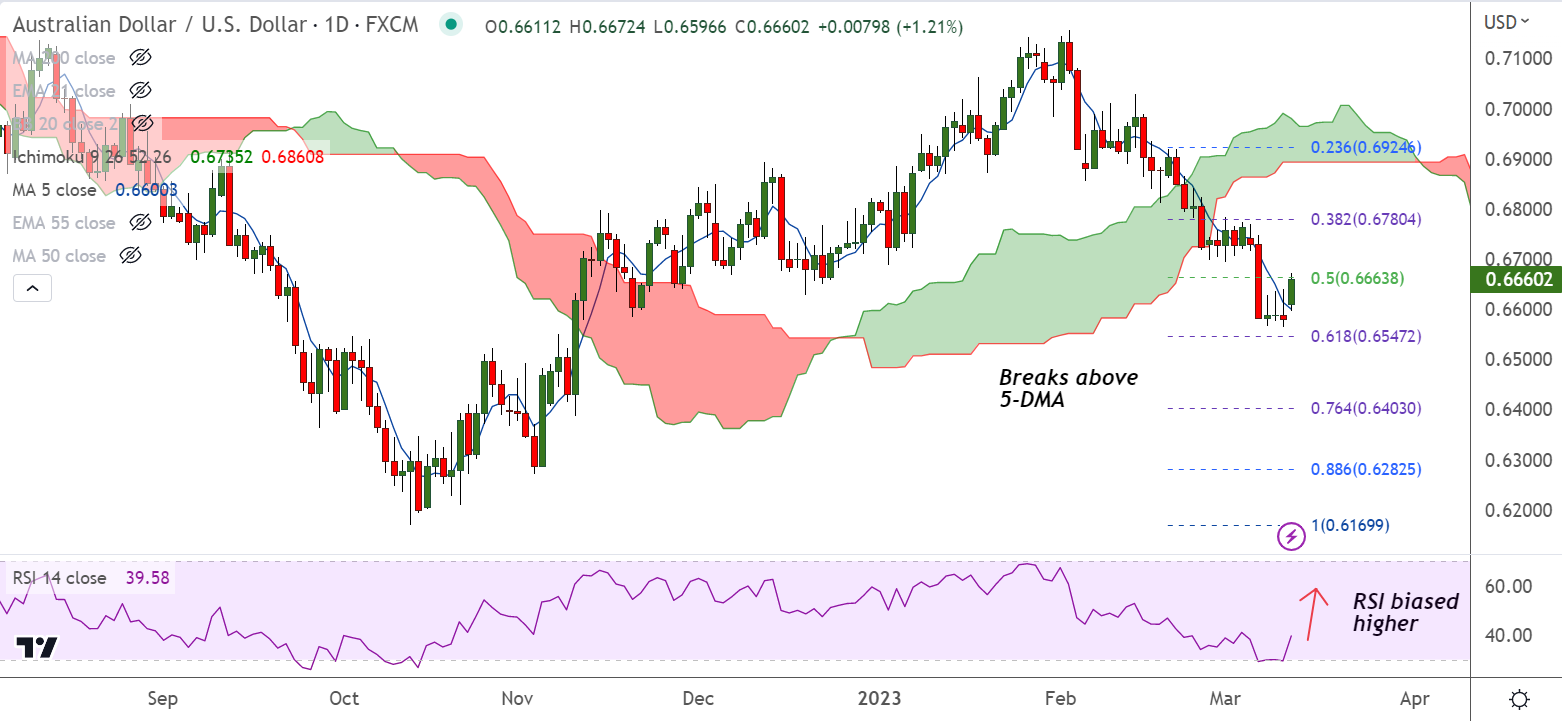

Chart - Courtesy Trading View

AUD/USD was trading 1.27% higher on the day at 0.6664 at around 06:30 GMT.

The pair broke consolidation and surged as bulls cheer SVB-led risk-on mood and receding hawkish Fed bets.

SVB collapse led investors to speculate that the Fed would now hesitate to hike interest rates by a super-sized 50 basis points this month.

The U.S. government announced several measures early on Monday so as to make additional funding available through a new Bank Term Funding Program.

Data released on Friday showed US Nonfarm Payrolls (NFP) grew more than 205K expected to 311K in February, versus 504K (revised).

The Unemployment Rate rose to 3.6% for the said month compared to 3.4% expected and prior. Further, the Average Hourly Earnings rose on YoY but eased on monthly basis.

Investor focus will now be on Tuesday's inflation data to gauge how hawkish the Fed is likely to be.

Technical bias for the pair is turning bullish. RSI has shown a bullish rollover from oversold levels. Chikou span is biased higher.

Price action is grinding sideways at 200H MA support. 5-DMA is still biased lower, but price action has edged above. Volatility is high.

Major Support Levels:

S1: 0.6599 (5-DMA)

S2: 0.6527 (Lower BB)

Major Resistance Levels:

R1: 0.6677 (200H MA)

R2: 0.6742 (21-EMA)

Summary: AUD/USD pivotal at 200H MA resistance. Technical indicators are still biased lower. but show signs of bullish reversal. Decisive break above 200H MA could change near-term direction.