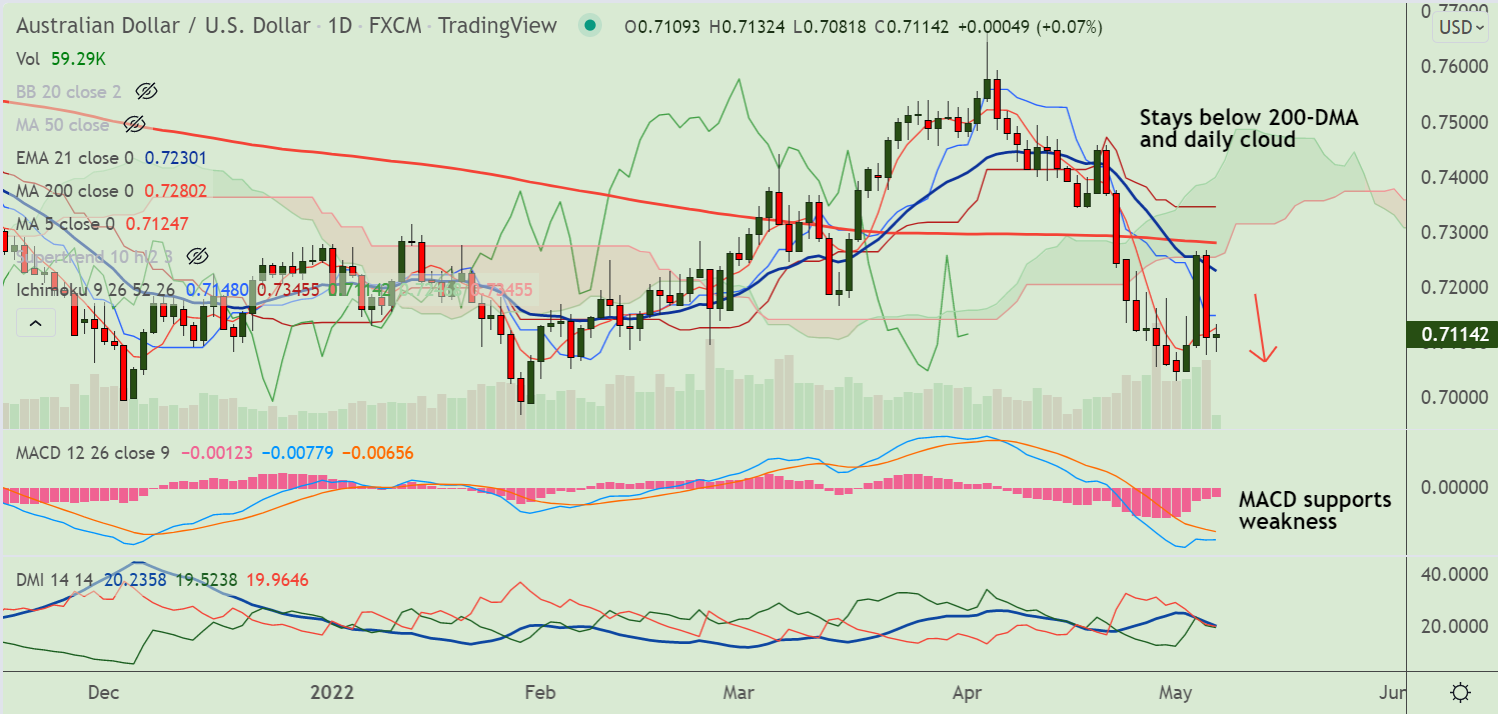

Chart - Courtesy Trading View

AUD/USD was trading largely muted at 0.7114 at around 03:50 GMT, slightly higher from session lows at 0.7081.

The Australian dollar remains depressed across the board after a dovish RBA Monetary Policy Statement.

Reserve Bank of Australia’s (RBA) quarterly Monetary Policy Statement (MPS) significantly revised up inflation forecasts, justifying the central bank’s latest rate hike.

The RBA says inflation pressures broadening due to supply chain bottlenecks, strong demand and expects core inflation above 2-3% band until 2024.

The RBA Statement also expects a 1.75% cash rate in December 2022, versus the latest print of 0.35%.

Focus now on US jobs report for April which will impact US dollar dynamics and hence determine short-term direction in the pair.

Analysts expect the headline US Nonfarm Payrolls (NFP) to ease to 391K from 431K whereas the Unemployment Rate may also decline to 3.5% from 3.6%.

Technical bias is bearish. Upside resumption unlikely till the pair stays below 200-DMA and daily cloud.

Major Support Levels:

S1: 0.7029 (May 2 low)

S2: 0.6960 (Lower BB)

Major Resistance Levels:

R1: 0.7124 (5-DMA)

R2: 0.7229 (21-EMA)

Summary: AUD/USD recovery lacks traction. Technical bias remains bearish. Resumption of weakness will see dip till 0.6967.