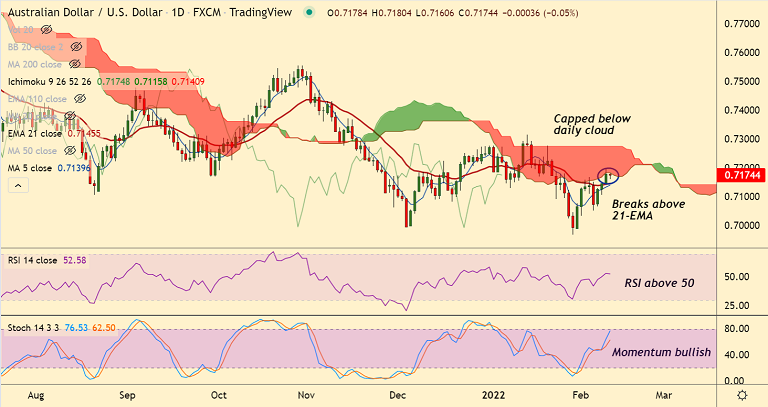

Chart - Courtesy Trading View

AUD/USD was trading 0.08% lower on the day at 0.7172 at around 04:55 GMT.

The pair has erased early losses and edged higher from session lows at 0.7160.

The Australian dollar buoyed on expectations of a hawkish stance from the RBA.

Markets have moved to price in more moves by the RBA, with the first move to 0.25% is implied by June. Further increases to 2.5% are priced in by July 2023.

Focus on the US CPI data scheduled later on Thursday for further impetus. A firmer-than-expected reading might trigger a further build-up of hawkish Fed bets.

Technical indicators are turning bullish. Oscillators are bullishly aligned. 5-DMA is on verge of bullish crossover on 20-DMA.

Price action is attempting retrace above 200-week MA. Weekly close above will fuel further upside.

Major Support Levels:

S1: 0.7145 (21-EMA)

S2: 0.7139 (5-DMA)

Major Resistance Levels:

R1: 0.7183 (55-EMA)

R2: 0.7220 (21-week EMA)

Summary: AUD/USD pivotal at 200-week MA. Decisive break above will fuel further gains.