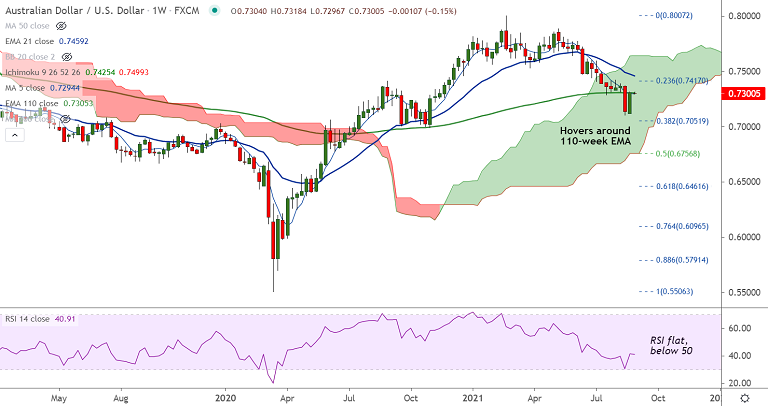

AUD/USD chart - Trading View

AUD/USD was trading 0.15% lower on the day at 0.7300 at around 05:15 GMT. The pair was struggling to extend Friday's gains.

Price action has tested 2-week highs after upbeat Australian Company Operating Profits data released earlier today.

The pair has slipped lower from session highs at 0.7218 as record covid cases in Australia and geopolitical jitters weigh on risk sentiment.

Aussie Company Gross Operating Profits crossed +3.0% market consensus and -0.3% prior with +7.1% QoQ figures for the second quarter (Q2).

On the other side, Australia's inventories dropped below 1.2% QoQ forecast and 2.4% prior to 0.2% during the stated period.

Focus will be on the US Pending Home Sales for July and Dallas Fed Manufacturing Business Index for August for impetus.

Major Support Levels:

S1: 0.7275 (5-DMA)

S2: 0.7218 (200-week MA)

S3: 0.72 (Psychological mark)

Major Resistance Levels:

R1: 0.7305 (110-week EMA)

R2: 0.7388 (50-DMA)

R3: 0.74

Summary: AUD/USD trades with a major bearish bias. But near-term bias is showing signs of some upside.

Price action has retraced above 200-week MA and is consolidating in weekly highs around 110-week EMA.

Decisive break above 110-week EMA will fuel more gains in the pair. Next major resistance lies at -DMA at 0.7388.