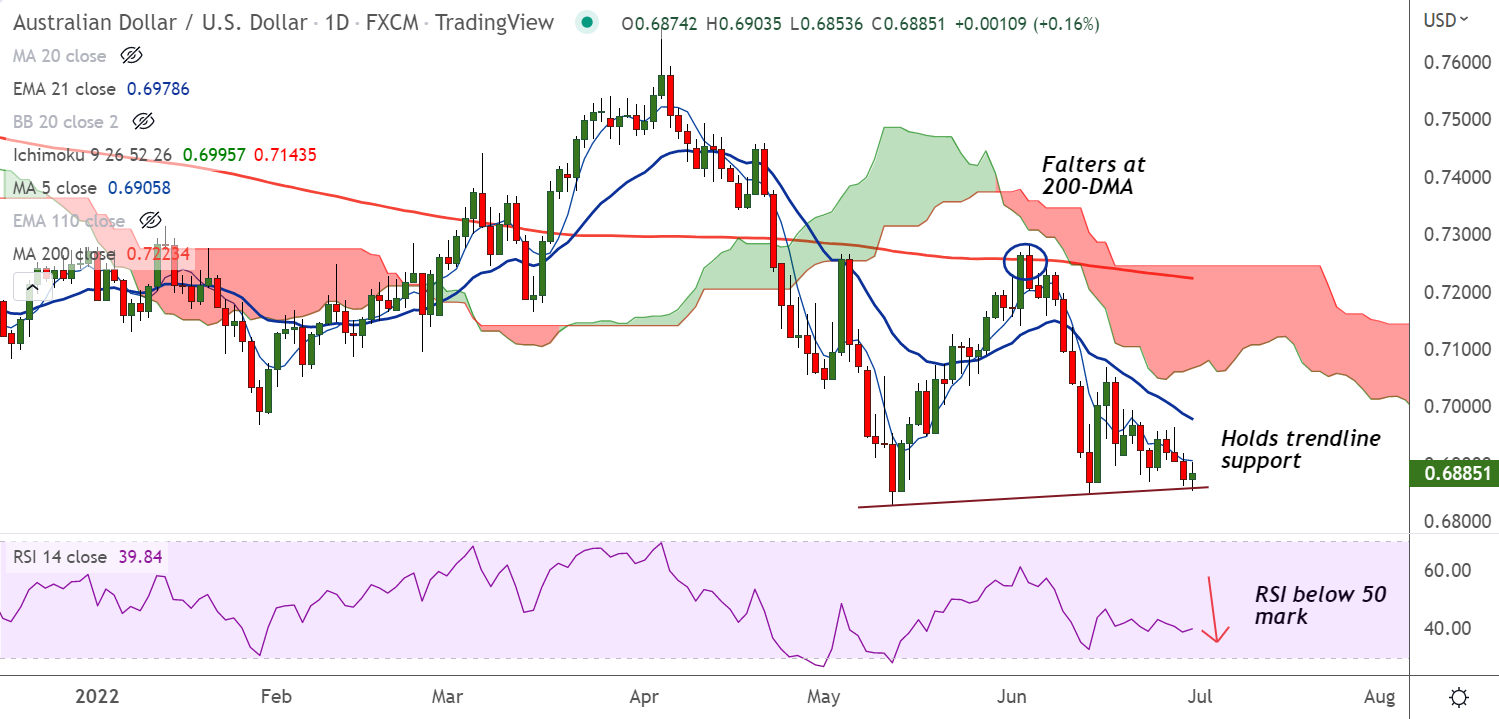

Chart - Courtesy Trading View

AUD/USD was trading 0.28% higher on the day at 0.6893 at around 05:10 GMT, recovery lacks traction.

The pair has snapped a three-day bearish streak and edged higher as Aussie bulls cheer upbeat China PMI data.

China’s headline NBS Manufacturing PMI rose to 50.2 versus 49.6 prior, versus 50.4 forecasts. While, Non-Manufacturing PMI rallied to 54.7 versus 52.5 expected and 47.8 prior.

Focus going forward will be on the Fed’s preferred inflation gauge, the Core Personal Consumption Expenditure (PCE) Price Index, for May.

Technical Analysis:

- AUD/USD recovery capped at 5-DMA, major moving averages are biased lower

- GMMA indicator shows major and minor trend are strongly bearish

- Price action has bounced off major trend line support

- Momentum is bearish and volatility is high and rising

Major Support Levels: 0.6828 (May 12 low), 0.6786 (Lower W BB)

Major Resistance Levels: 0.6905 (5-DMA), 0.6925 (200H MA)

Summary: AUD/USD recovery lacks traction. Major trend in the pair is bearish. Watch out for break below trendline support for further weakness.