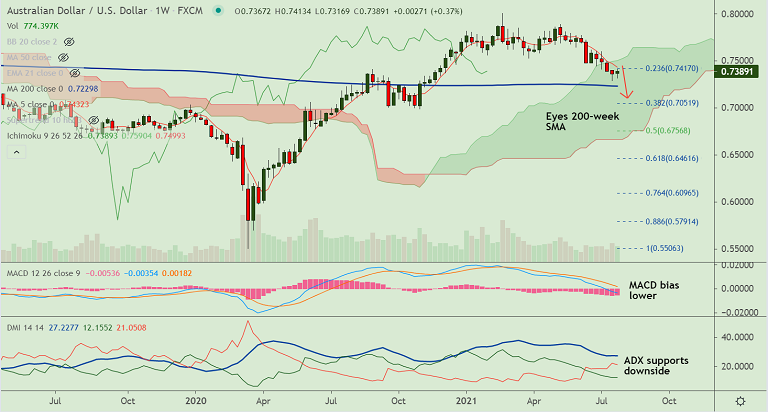

AUD/USD chart - Trading View

Technical Analysis:

AUD/USD is on track to close in the green after 4 consecutive weeks of declines, but upside looks limited.

The pair was trading 0.06% lower on the day at 0.7389 at around 04:15 GMT, struggles to extend overnight gains.

Australia’s Q2 Producer Price Index (PPI) rose past 0.2% forecast and 0.4% prior to 0.7% QoQ whereas the Private Sector Credit for June also crossed 0.1% expectations and 0.4% previous readouts to 0.9% MoM.

Upbeat data failed to boost the Australian dollar. Risk off market sentiment put a safe-haven bid under the US dollar, dragging the pair lower.

Technical analysis shows neutral bias on the daily charts and weakness on the weekly charts.

'Death Cross' (bearish 50-SMA crossover on 200-SMA) on the daily charts keeps check on upside in the pair.

5-DMA is immediate support at 0.7378. Break below could see resumption of weakness. 200-week MA at 0.7229 is crucial support to watch.