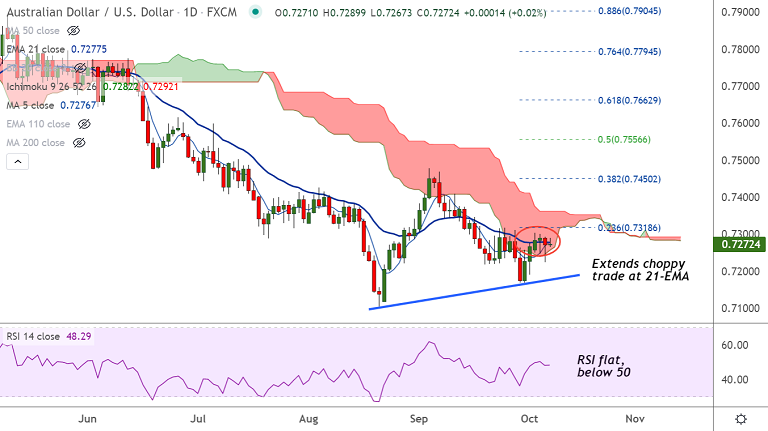

AUD/USD chart - Trading View

Spot Analysis:

AUD/USD was trading 0.03% higher on the day at 0.7273 at around 0550 GMT

Previous Week's High/ Low: 0.7310/ 0.7169

Previous Session's High/ Low: 0.7293/ 0.7226

Fundamental Overview:

Challenging the risk appetite are the recently rising covid numbers from Australia, up at 2,231 in the latest report.

A three-month high US ADP Employment Change which printed at 568K versus 340K prior, underpins hopes for a strong US NFP print.

Australia’s AiG Performance of Services Index for September rose to 45.7 from 45.6 while the weekly prints of ABS Wages and Payroll figures came in mixed.

US policymakers’ voting on the debt ceiling extension will be the key for USD dynamics and further price movement.

Chinese market sentiment will also be a crucial driver. Chinese markets will reopen on Friday after a week-long public holiday.

Technical Analysis:

- AUD/USD extends sideways along 21-EMA

- The pair continues rangetrade along 200-week MA support

- RSI is flat and below the 50 level mark, while Stochs are biased higher

- Price action is consolidating break into daily cloud

Major Support and Resistance Levels:

Support - 0.7211 (200-week MA), Resistance - 0.7304 (50-DMA)

Summary: AUD/USD struggles to find clear direction. Focus on US non-farm-payrols data for impetus.