• AUD/USD edged higher on Monday as the greenback remained under pressure following Trump’s criticism of Fed Chair Powell and concerns over a ballooning US spending bill.

• Investors are closely watching Trump’s sweeping tax-cut and spending proposal, now before the Senate, which the CBO estimates could add $3.3 trillion to the national debt over the next decade.

• The Iran-Israel ceasefire following a 12-day conflict appeared to be holding, easing safe-haven demand further.

• Looking ahead, Australia will release May retail sales data on Wednesday, with forecasts pointing to a 0.3% rebound following April’s decline. Recent rate cuts are expected to support consumer spending.

• At GMT 05:36, the Australia dollar was up 0.34% to 0.6551 against the US dollar.

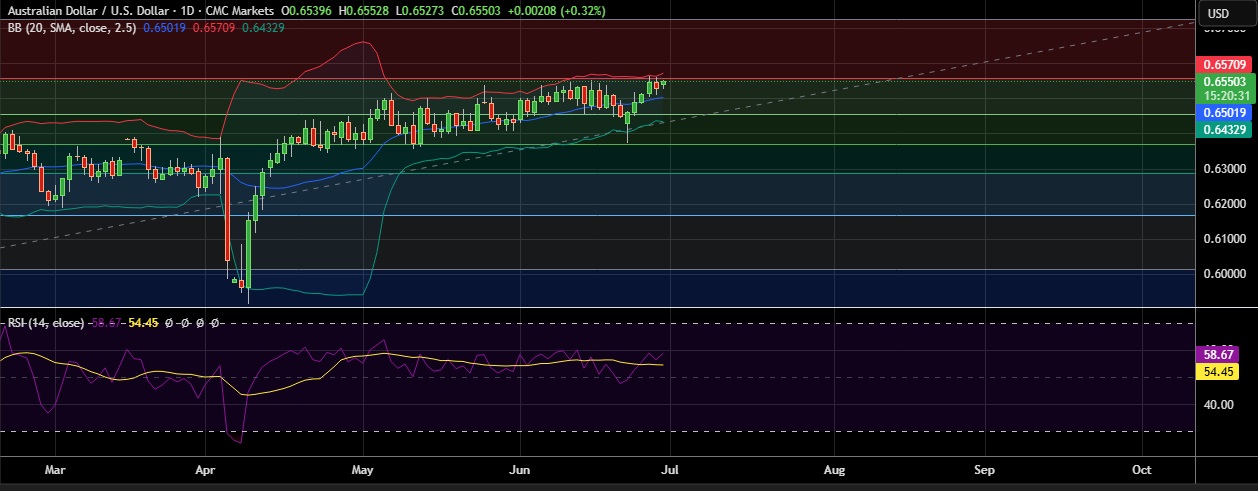

• Immediate resistance is located at 0.6557(23.6%fib), any close above will push the pair towards 0.6572(Higher BB).

• Support is seen at 0.6506 (SMA 20) and break below could take the pair towards 0.6455(38.2%fib).

Recommendation: Good to buy around 0.6530 with stop loss of 0.640 and target price of 0.6630