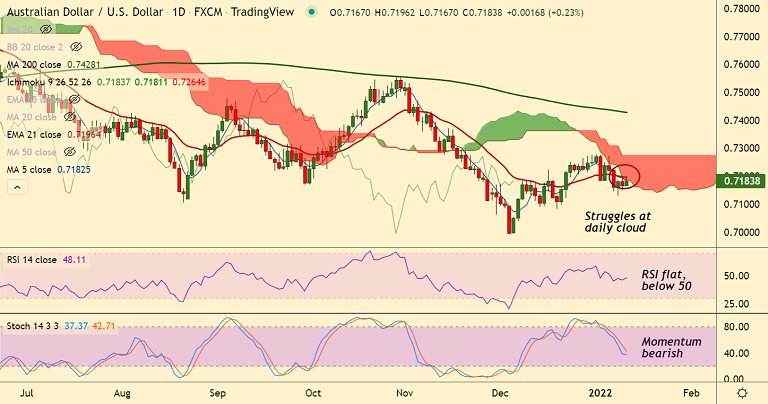

Chart - Courtesy Trading View

Technical Analysis:

GMMA Indicator

- Major and minor trend are bearish

Ichimoku Analysis

- Price action is capped at daily cloud

- Chikou span is biased higher

Oscillators

- RSI is flat, below the 50 mark

- Stochs are biased lower

Bollinger Bands

- Bollinger bands show constriction

- Volatility is shrinking

Major Support Levels: 0.7170 (200-week MA), 0.7113 (Lower BB)

Major Resistance Levels: 0.7197 (21-EMA), 0.7213 (200H MA)

Summary: AUD/USD struggles for direction at 21-EMA and daily cloud resistance. Technical indicators show a bearish tilt. Break out above 21-EMA could change near-term bias. Focus on US inflation data and Fed speech for impetus.