Refer AUD/USD chart on Trading View

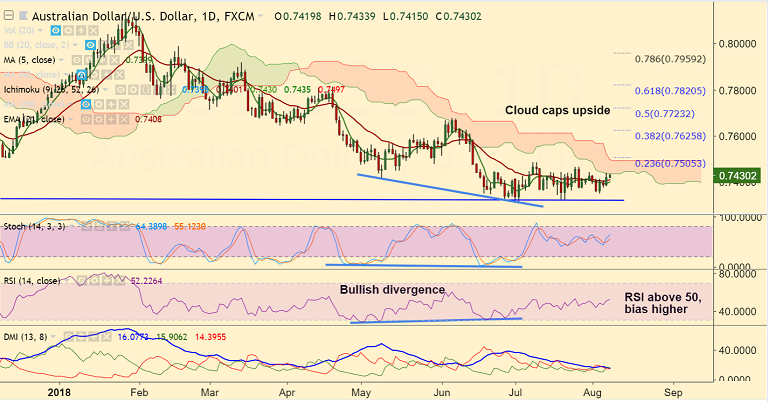

- AUD/USD is trading in a narrow range, with the day's high at 0.7433 and low at 0.7415.

- The RBA held rates and statement was largely unchanged from the previous month. No clear policy bias left bulls unimpressed.

- RBA Governor Lowe's speech and China trade data released earlier today weighing on the Aussie.

- RBA's Lowe sounded upbeat on the economy but is no hurry to raise rates, while China's trade surplus narrowed in July.

- China's trade surplus came in at CNY 176.96 billion in July, missing estimates for a rise to CNY 280.90 billion and compared to previous month's print of CNY 261.90 billion.

- AUD/USD holds above 0.74 handle, finds support at 21-EMA at 0.7407.

- Upside seems to be capped at daily cloud, break above required for further upside.

- We see bullish divergence on Stochs and RSI which keep scope for upside in the pair.

Support levels - 0.7407 (21-EMA), 0.7398 (5-DMA), 0.7325 (trendline)

Resistance levels - 0.7435 (cloud), 0.7452 (55-EMA), 0.7505 (23.6% Fib)

Recommendation: Watch out for break into daily cloud, target 0.75/ 0.7540

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at 67.3668 (Neutral), while Hourly USD Spot Index was at -68.9452 (Neutral) at 0500 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.