From the nutshell, 25-delta risk of reversals of EUR/CHF the second most expensive pair to be hedged for downside risks after AUDUSD as it indicates puts have been over priced.

Delta risk reversals of EURCHF for next 6 months: The OTC options market appeared to be more balanced on the direction for the pair over the 1m to 1y time horizon and as a result delta risk reversal for EURCHF was turning into negative (sentiments towards downside protection is relatively more expensive).

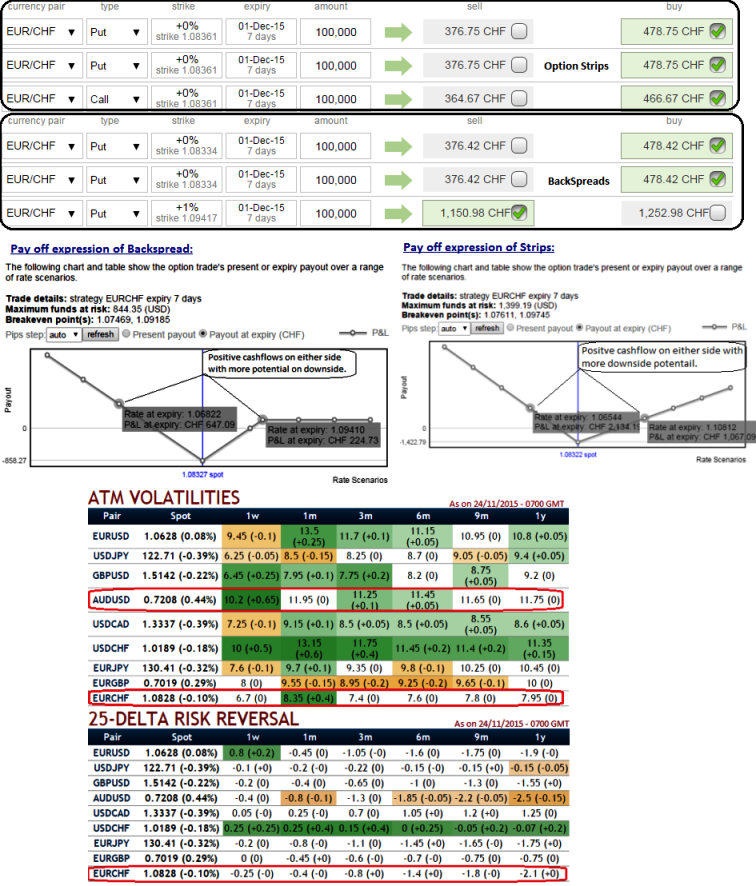

Comparative Analysis of Option Strips and BackSpreads: EURCHF

With the above risk reversal reasoning, we recommend arresting further downside risks of this pair by Put Ratio back Spread instead of strips which involves extra cost even though both strategies serve similar purpose from 3rd option (short in PRBS & long call in strips).

Strips employs an ATM call along with the puts double the size of call, but in the above explained scenario we think those who so are so bearish in long run but some steep spikes in short run, OTM shorts with very shorter term expiries are recommended (see lower negative risk reversals in the near term which means less bearish in 1 weeks time frame that could be utilized for ATM shorts).

By doing so, one can participate in tiny rallies within 2-3 days time and it also reduces the cost of hedging because of the initial receipt of premiums. Whereas, strips cost extra by deploying an additional call option in this strategy.

So, purchase 1M 2 lots of At-The-Money -0.51 delta puts and sell 3D or 1w one lot of (1%) In-The-Money put option with positive theta.

Hedging cost of option strips = CHF 1424.17 (at net debit).

Hedging cost of backspreads = - CHF 194.14 (at net credit).

As shown in the diagram, use shorter expiries (2D or 3D) for OTM put writing that funds CHF 189.78 to the purchase of the greater number of long puts and the position is entered for no cost or reduced cost.

FxWirePro: Aggressive bears preferring EUR/CHF backspreads i/o option strips to reduce hedging cost

Tuesday, November 24, 2015 1:58 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro: GBP/AUD extends drop, vulnerable to more downside

FxWirePro: GBP/AUD extends drop, vulnerable to more downside  FxWirePro: GBP/NZD attracts selling interest, vulnerable to more downside

FxWirePro: GBP/NZD attracts selling interest, vulnerable to more downside  FxWirePro- Major European Indices

FxWirePro- Major European Indices  FxWirePro:EUR/AUD upside limited, scope for a dve through a key fibo

FxWirePro:EUR/AUD upside limited, scope for a dve through a key fibo  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro: EUR/NZD recovers slightly but bears are not done yet

FxWirePro: EUR/NZD recovers slightly but bears are not done yet  FxWirePro: GBP/USD slips ahead of Manchester local election

FxWirePro: GBP/USD slips ahead of Manchester local election  ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000

ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize

Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  FxWirePro: USD/JPY dips as yen gains after Tokyo CPI data

FxWirePro: USD/JPY dips as yen gains after Tokyo CPI data  Pound Sell-Off Accelerates: GBP/JPY Drops to 209.93, Eyes Major Support Zone

Pound Sell-Off Accelerates: GBP/JPY Drops to 209.93, Eyes Major Support Zone  FxWirePro: USD/CAD steadies around 1.3680,retains bid tone

FxWirePro: USD/CAD steadies around 1.3680,retains bid tone  FxWirePro: USD/ZAR edges higher but bearish outlook persists

FxWirePro: USD/ZAR edges higher but bearish outlook persists  FxWirePro: AUD/ USD edges up as Australian dollar gains on hawkish RBA outlook

FxWirePro: AUD/ USD edges up as Australian dollar gains on hawkish RBA outlook