The Antipodean pair now wants to retest the 1.0800 area, which looks vulnerable to giving way to 1.0750.

We expect NZD to fall through this year, reaching 0.63 at year-end. The support to growth from migration will fade, while the RBNZ – at the very least – is likely to hold rates steady as inflation normalizes, pushing real rates materially lower.

The economy is also now subject to credit tightening through numerous channels: macro-prudential constraints, regulatory initiatives, widening mortgage rate spreads, and banks’ discretionary tightening of credit criteria to businesses.

We now expect the RBNZ to be on hold this year, but there is a clear downside risk to the OCR over the course of the year.

On the flip side, a steady hand from the Fed in June plus an optimistic RBA should limit downside on AUDUSD during the next few months. Further out, though, the underlying AUD trend should be gently lower, as growing bulk commodity supply gradually cools the 2016 price surge. Iron ore should be back under $80/tonne by June, with further (modest) declines likely in H2 2017.

AUDNZD in medium term perspectives: Higher to 1.10+ but for now, slightly weaker. The cross remains well below fair value estimates implied by interest rates, commodity prices, and risk sentiment, although is closing the gap.

Hedging Framework:

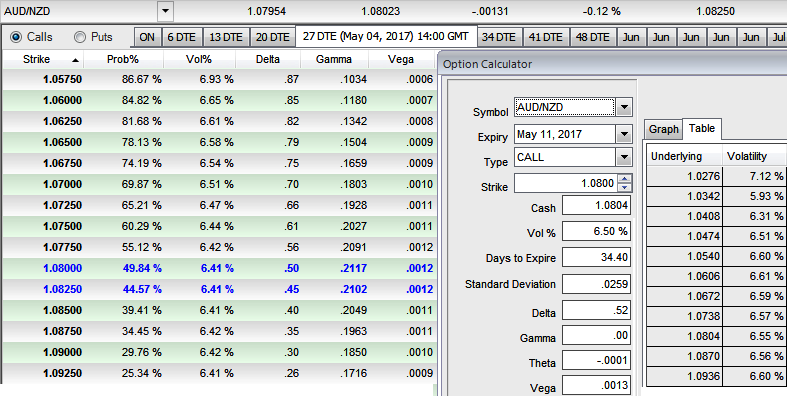

3-Way Options straddle versus OTM Call

Spread ratio: (Long 1: Long 1: Short 1)

The execution: Initiate long in AUDNZD 3M at the money vega put, long 3M at the money vega call and simultaneously, Short theta in 1m (1%) out of the money call with positive theta or closer to zero.Theta is positive; time decay is bad for a buyer, but good for an option writer.

Rationale: As you could observe the higher probability of underlying spot is on OTM put strikes and their corresponding vega of long leg (buy) options position is reasonably healthier on either side and it implies that if IV increases or decreases by 1%, the option’s premium would have an impact in increase or decrease proportionately. And IVs of 1m tenor is on lower levels, good news for option writers.

Hence, we encourage vega longs and short thetas in the non-directional trending pair but slightly favors bearish strategy as the vega signifies the sensitivity of an option’s value owing to a shift in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan