Gold futures for August delivery on the Comex division of the NYME rallied to a daily peak of $1,253.50 a troy ounce, the most since last 3 weeks.

Safe-haven demand is strengthened again Fed’s stance on monetary policy, defy market expectations for rate hikes.

Yellow metal resume gaining especially after Yellen hinted dovish moves from Fed, the prices have been sensitive to moves in U.S. interest rates. The gradual path to higher rates is seen as less of a threat to gold prices than a swift series of increases.

Well, approximately about a month ago we had advocated a hedging strategy (3-Way Options Straddle versus calls), as the shorts on calls would have been a certain yields by now we now like to append existing portfolio with writing an OTM put option so as to match the trend.

For more reading on the previous strategy follow below link:

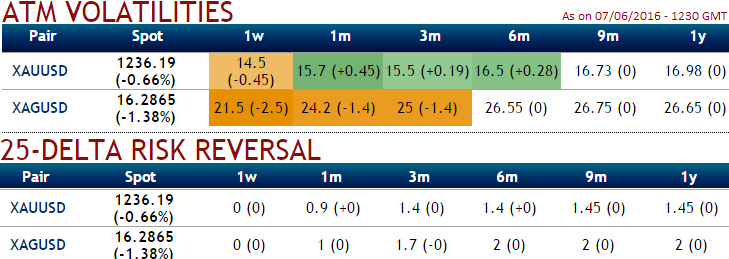

OTC Observation: The implied volatility of 1W XAU/USD ATM contracts have reduced below 15% (14.5 to be precise) and 15.7% for 1m tenors.

Although the risk reversals are still signaling upside risks in the long run, hedgers seem to be neutral in near terms ahead of Fed’s monetary policy guidance.

Well, considering above fundamental developments in bullion markets we could now foresee the juicy times in writing an OTM puts to the existing strategy.

More evidently, the precious yellow metal prices could surge further on a broadly weaker U.S. dollar and indications that the Federal Reserve was in no hurry to raise interest rates boosting the yellow metal again.

Thereby, the alteration goes this way, go long in XAU/USD 2M At the money delta put, Go long 4M at the money delta call and simultaneously, Short 2W (1%) out of the money put with positive theta.

Rationale: Bidding short term neutral risk reversals with writing 2W OTM put contracts, as stated above bullion market remains safe-haven demand which is why longer tenor calls.

Please be noted that as the cash inflows as the underlying prices keep spiking, their corresponding payoff structure has been exponential, for every rise in the spot the corresponding payoffs would be doubled.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data