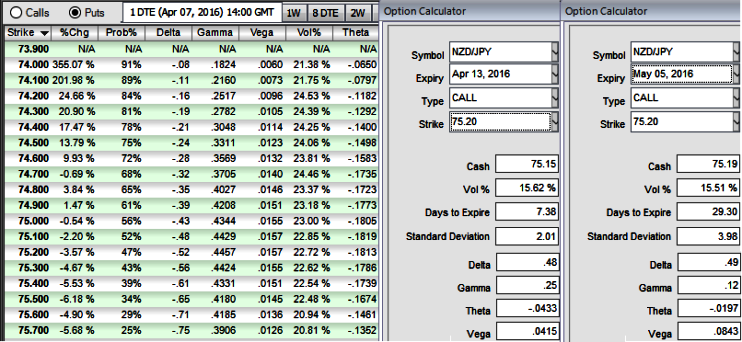

1W ATM IVs of the pair is at 15.62% and 15.51% for 1M tenor.

Glance the eyes on sensitivity table for probability numbers for OTM striking call in 1 week's tenors.

You could also observe the attractive %change in premiums, when compare this with probability numbers you could very well understand that this would be due to momentary gains (see for bearish pressures on technical charts).

hence, in order to participate in the prevailing bear run, a protective call strategy is advocated as if you are still bearish on the underlying but suspicious of uncertainties in the near term.

The call option is thus purchased to protect unrealized gains on the existing short position in the underlying spot FX.

Remember while selecting strikes of call, an at-the-money call option that has a strike price that is equal to the market spot price of the underlying asset. Like OTM strikes, ATM options possess no intrinsic value and contain only time value which is greatly influenced by the volatility of the underlying spot FX and the passage of time.