Crude prices surged 4% after an OPEC agreement to raise output less than feared which in turn appeared to cushion commodity pairs like CAD, AUD and NZD outperform.

While precious yellow metal edged lower at the beginning of a new trading week, although it has managed to regain early lost ground and is currently hovering in the neutral territory around the $1267 region.

One interesting defensive RV set-up is long Gold/AUD ATM vs. short AUDUSD puts (both legs delta-hedged).

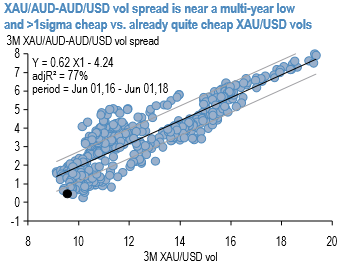

At multi-year lows, an artifact of uber-depressed Gold vols, the XAUAUD - AUDUSD vol spread can be considered to be an RV-friendly expression of outright XAUUSD vol (refer 1st chart), which by all accounts is quite cheap in its own right.

AU swap yields 1-3 month: Our RBA outlook (on hold throughout 2018) is anchoring short-maturity interest rates and should keep 3yr swap rates in a 1.80% to 2.30% range, as long as core inflation remains below 2%. Longer maturity rates will largely follow US rates.

As we have flagged on a number of occasions and as many vol investors are well aware, owning AUDUSD skews (delta-hedged) has been one of the most reliable money losers in the post-GFC years since the reduction of RBA cash rates to all-time lows has decimated the erstwhile speculative carry positioning base in the currency and rendered it a pale shadow of its former high-beta self, with the result that the much more modest (inverse) spot-vol correlation these days during market disruptions no longer justifies a hefty premium for AUD puts over AUD calls.

We recommend defensive RV in form of buying2M XAUAUD ATM @7.9/8.6vol vs. shorting AUDUSD @ 8.2 vol indic 25 delta puts, in vega neutral notionals.

Adirectional twist to the above vol spread that also utilizes the RV advantage can be structured as long XAUAUD calls vs. short AUD puts/USD calls, a lower-cost expression of long XAU/USD calls. Notably, the spread has a track record of delivering better P/Ls than outright XAUUSD calls (refer 2nd chart) at a fraction of the cost (refer 3rd chart).

We recommendbuying 2M 35 delta XAU calls/AUD puts @ 8.3/9.1 vols vs selling 35 delta AUD puts/USD calls @ 7.75 vols (ref spot 0.7564) in equal notionals, costs @10bp AUD. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes