The bulls of AUDUSD seem to have been exhausted momentarily at the peaks of 0.8065 levels.

On the flip side, the major trend has been drifting in range bounded trend, but for now, bulls have managed to break the long lasting range resistance of 0.7835 (April’2016 highs) (refer monthly chart).

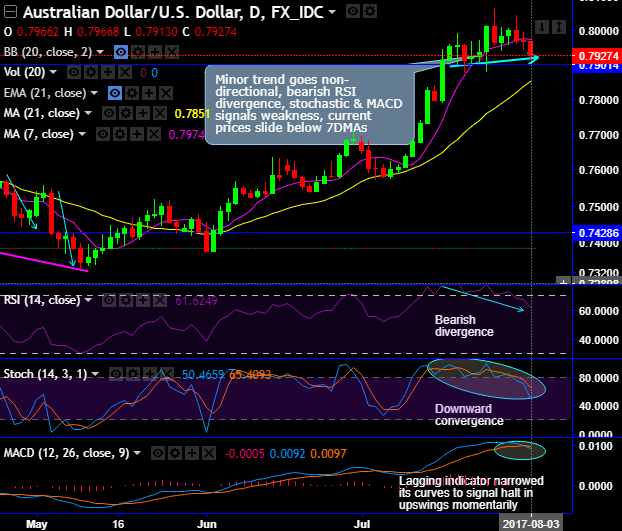

Well, as stated in our previous write up on technicals, the minor trend drifts below 7DMAs and evidencing bearish effects.

The previous month the rallies have hit multi-months highs. The minor trend goes non-directional as the bearish RSI divergence, %D crossover on stochastic curve & MACD signals weakness (refer daily chart).

As a result, the current prices slide below 7DMAs.

MACD: Lagging indicator narrowed its curves to signal a halt in upswings momentarily.

Today, it is most likely to test the strong support at 0.79 levels (which is just 25-30 pips away from spot levels), should the rallies extend from the current levels, the chances of hitting 0.7975 mark (i.e. 7DMA which is just 50 pips away from current levels).

On broader perspectives, the consolidation phase was consistently restrained at 0.7780, 0.7828 and 0.7835 levels. But for now, upswings have surpassed these levels and the current price on this timeframe is hovering above 21EMAs (refer monthly chart).

The momentum indicators (on this time frame) have been slightly indecisive but has been converging to the ongoing uptrend to signal the strength, RSI exhausted at 70 levels on monthly which is overbought zone but diverging at 58 levels on daily plotting.

The prevailing upswings are favored by MACD oscillator on monthly terms and downswings in short term that signal respective trend patterns to prolong further.

Trade tips: Contemplating this technical reasoning, on trading perspective, it is advisable to buy double no touch binary options with two strikes – upper strikes at 0.7975 levels and lower strikes at 0.7890 (keep 10-15 pips tolerance from the above-stated support levels).

With the double no-touch binary options trade, the binary options trader selects a set of strike prices above and below the current market price as well as an expiration time. The broker will offer him a payout percentage corresponding to his selection.

The payoff structure is dependent on the price of the underlying spot price that should not hit either one of the strike prices once before the option expires.

Currency Strength Index: FxWirePro's hourly AUD spot index is popping up at -52 levels (which is bearish), while hourly USD spot index was at shy above -3 (neutral) at 07:44 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: