The APAC currencies (Australian and New Zealand dollar) moved lower against their U.S. counterpart on yesterday, after the Reserve Bank of Australia indicated the likelihood for additional rate cuts as businesses seem edgy ahead of today's Fed's monetary policy decision.

In the minutes of its March policy meeting, the RBA mentioned that low inflation refers the central bank isn't ruling out further interest rate cuts but the adoption of negative interest rates by other central banks is creating uncertainty.

The minutes also showed that policymakers spent part of the meeting discussing China's 'longer-run economic performance and risks to growth' in Australia's biggest trading partner.

On the flip side, Federal Reserve is lined up for its monetary policy review and decision during U.S. session, which is likely remain unchanged, it may be disappointed by yesterday’s softer consumer spending report, the release should not alter their plans to raise interest rates in 2016.

Hedging Strategy:

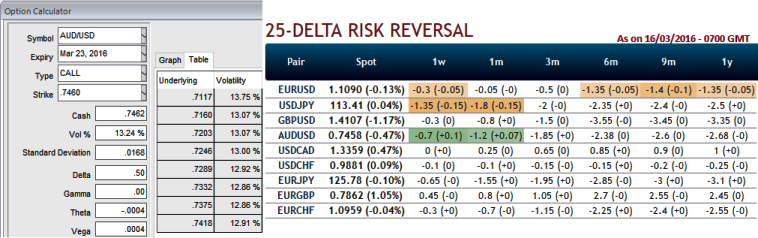

Have a glance on 13.24% for 1W ATM implied volatilities of AUDUSD, reduced a bit ahead of lingering larger expectation of Fed to stand pat on its rates. Spot FX participants think nothing dramatic changes in this pair but to continue its long term trend.

This has been signalled by risk reversal numbers as there slight rise in downside hedging sentiments, OTC participant seem that they are willing to pay more premiums on OTM puts.

Subsequently, we expect AUDUSD drop again, so foreign trader whose short term payables in Aussie dollar can go opt below hedging strategy.

On a hedging perspective, debit put spreads are advocated as the selling indications are popping up on technical graphs. So buying In-The-Money Puts and to reduce the cost of hedging by financing this long position, selling an Out-Of-The-Money put option is recommended.

So, the strategy goes this way, go long in 1M (1%) in the money -0.49 delta put, and short 1W (1%) out of the money put option with positive theta for a net debit to enter the positions.