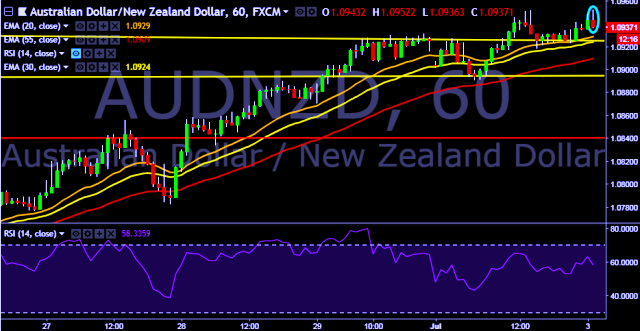

- AUD/NZD is currently trading around 1.0939 marks.

- Pair made intraday high at 1.0952 and low at 1.0923 marks.

- Intraday bias remains neutral till the time pair holds key resistance at 1.0952 mark.

- A sustained close above 1.0925 will drag the parity higher towards key resistances at 1.0998/1.1072/1.1122 levels respectively.

- Alternatively, a daily close below 1.0925 will take the parity down towards key supports around 1.0870/1.0782/1.0658/1.0572/1.0502 marks respectively.

- Important to note here that 20D, 30D and 55D EMA heads up and confirms the bullish trend in a daily chart.

- Australia May building approvals -3.2 pct m/m, s/adj (poll +1.0 pct).

- Australia May private sector house approvals -8.6 pct m/m, s/adj.

- Australia's S&P/ASX 200 index up 0.19 pct at 6,189.30 points in early trade.

- RBA will release cash rate decision at 0430 GMT.

FxWirePro: Aussie falls against major peers as building approvals data misses expectations, RBA’s cash rate decision in focus

Tuesday, July 3, 2018 1:59 AM UTC

Editor's Picks

- Market Data

Most Popular