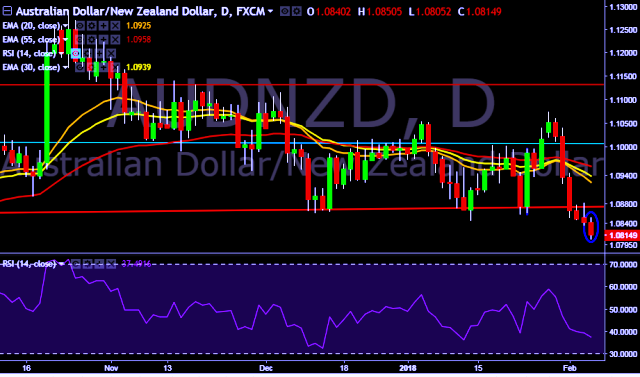

- AUD/NZD is currently trading around 1.0817 marks

. - Pair made intraday high at 1.0850 and low at 1.0805 marks.

- Intraday bias remains bearish for the moment.

- A sustained close above 1.0840 will drag the parity higher towards key resistances at 1.0945/1.1072/1.1113/1.1163/1.1238/1.1289/1.1384 levels respectively.

- Alternatively, a daily close below 1.0840 will take the parity down towards key supports around 1.0798, 1.0737 and 1.0693 marks respectively.

- Australia's S&P/ASX 200 index down 2.70 pct at 5,863.50 points in early trade.

- Australia Dec retail sales m/m decrease to -0.5 % (forecast -0.2 %) vs previous 1.2 %.

- Australia Dec trade balance G&S (A$) decrease to -1358 mln au (forecast 200 mln au) vs previous -628 mln au.

- RBA will release cash rate decision at 0330 GMT.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest