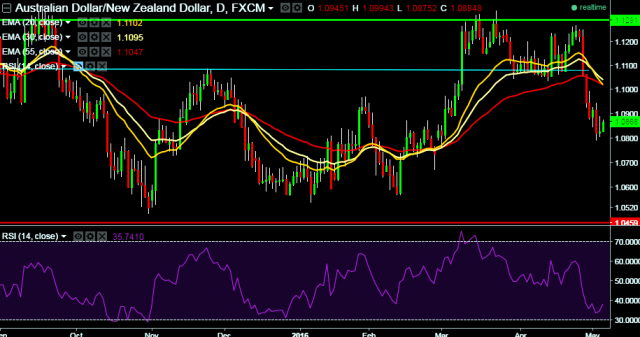

- AUD/NZD is trading around 1.0872 marks.

- Pair made intraday high at 1.0875 and low at 1.0827 marks.

- Today Australia released retails sales data with positive numbers at 0.4% m/m vs 0.0% m/m previous release.

- On the other side, Australia’s new home sales picked up at the strongest pace since 2010 to 8.9% month-on-month vs -5.3% month-on-month previous release.

- In addition, Australia’s trade deficit contracted from a revised $3.04 billion in February to $2.16 billion the following month.

- Intraday bias remains bullish till the time pair holds immediate support at 1.0804 marks.

- A daily close below 1.0832 will take the parity down towards 1.0801/1.0735/1.0651 marks respectively.

- On the other side, a sustained close above 1.0885 will drag the parity higher towards 1.0976/1.1062/1.1123/1.1298/1.1317 levels.

We prefer to take long position in AUD/NZD at 1.0850, stop loss 1.0804 and target 1.0976/ 1.1062 marks.