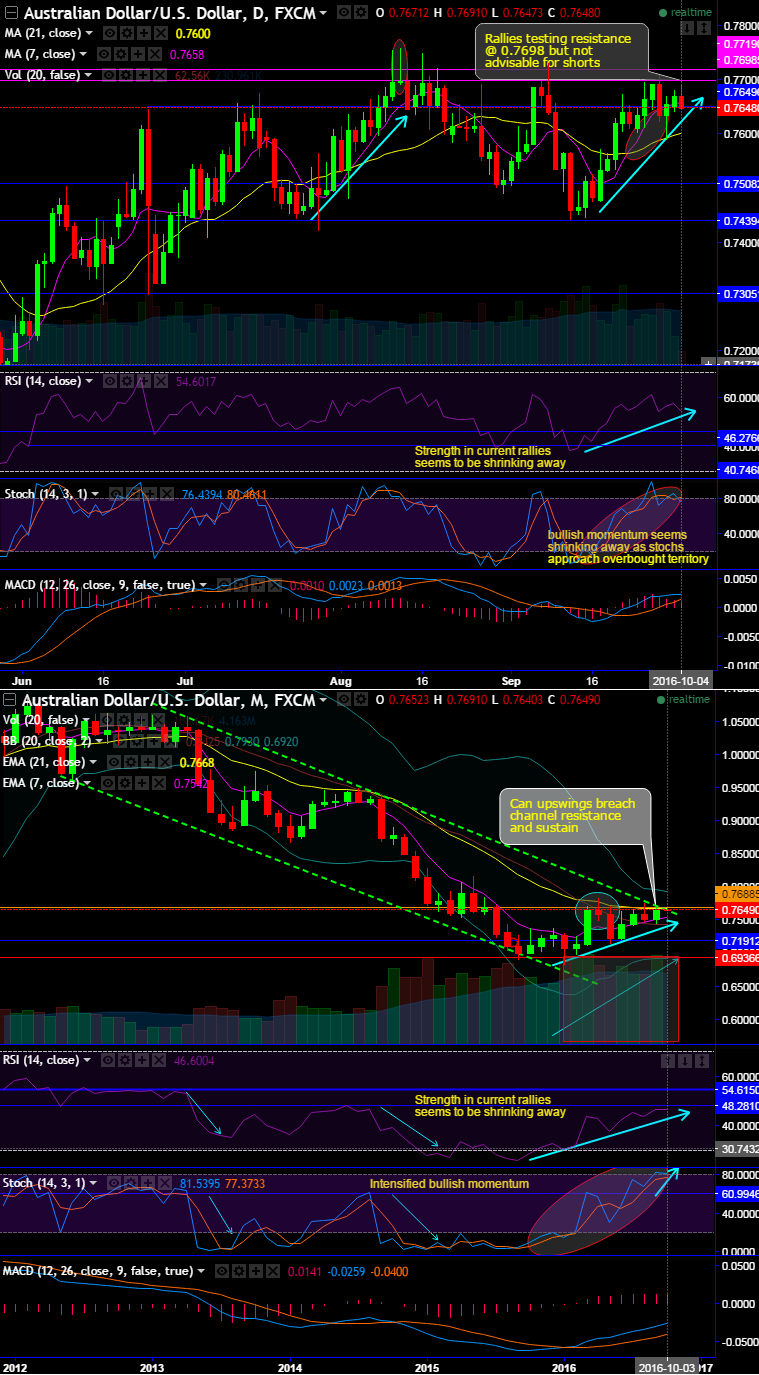

Despite the current bearish swings, we reckon bulls have the upper hand and more chances to rise as they managed to break out above the stiff resistance at 0.7650 and now acting the same level as strong support.

Moreover, the current dips are not substantiated by any supportive signals by leading or even by lagging oscillators.

Fundamentally, RBA today maintained status quo in its monetary policy, left cash rates unchanged at 1.50% which is line with the expectations, but cited concerns on growth over a strong currency, and after building and housing data that showed a continued negative trend though above expectations.

Consequently, we could foresee the upside potential up to reclaim at the next strong resistance at 0.7698 mark, which means upward travel of another 40-50 pips can be possible as we see the pair holding strong support at 0.7650 levels and additionally there is no clear bearish indications also from leading oscillators.

Hence, intraday and short-term speculators can eye on bullish targets.

On the contrary, the major downtrend has been sliding through the sloping channel but for now, in consolidation mode, restrain below 21EMA and channel resistance.

The current prices on monthly charts have now reached channel resistance, and the pair at this juncture has been failing quite often to reject at channel resistance, so the question, for now, is that can the prevailing upswings break & sustain above channel resistance?

We think if it doesn't manage to break out above decisively on a closing basis which would likely to resume bearish potential in the days to come. Both leading and lagging indicators are in conformity to the uptrend on the monthly timeframe.

Trading tips:

Aussie gains and likely to extend the same on Reserve Bank of Australia’s stances. On speculative grounds, it is wise to capture dips to deploy one touch binary call options with ITM strikes for targets of 40-50 pips above. We prefer this strategy as the intermediate bull trend still seems intact and entry prices are available at cheaper prices as stated above strong support is seen at 0.7650 levels.