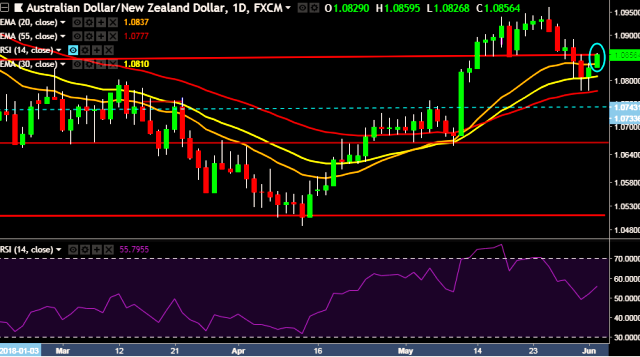

- AUD/NZD is currently trading around 1.0850 marks.

- Pair made intraday high at 1.0859 and low at 1.0826 marks.

- Intraday bias remains bullish till the time pair holds key support at 1.0776 mark.

- A sustained close above 1.0827 will drag the parity higher towards key resistances at 1.0856/1.0927/1.0998/1.1072/1.1122 levels respectively.

- Alternatively, a daily close below 1.0827 will take the parity down towards key supports around 1.0776/1.0736/1.0620/1.0572/1.0506 marks respectively.

- Important to note here that 20D, 30D and 55D EMA heads up and confirms the bullish trend in a daily chart.

- Australia Q1 gross company profits increase to 5.9 % (forecast 3 %) vs previous 2.2 %.

- Australia April retail sales m/m increase to 0.4 % (forecast 0.2 %).

- Australia's S&P/ASX 200 index up 0.67 pct at 6,030.40 points in early trade.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest