Australia reported a trade deficit of AUD 0.63 billion in November of 2017, an increase of 108 percent from a downwardly revised AUD 0.30 billion gap in the prior month and missing market expectations of an AUD 0.55 billion surplus.

Exports were flat from a month earlier at AUD 31.85 billion while imports rose 1 percent to reach an all-time-high of AUD 32.48 billion. Considering January to November 2017, trade balance came in at AUD 12.17 billion surpluses, compared to an AUD 14.68 billion deficit in the same period of the preceding year.

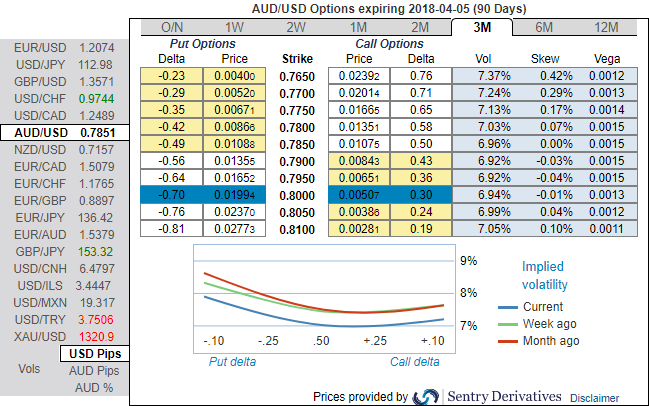

Please be noted that the positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes upto 0.76 levels (above nutshell). While bearish neutral delta risk reversal indicates that the hedging activities for the downside risks remain intact.

Noticeably, ATM IVs of 2m expiries are just shy above 6.35%. Hence, the lower IVs are deemed as the right time to write overpriced OTM puts.

Accordingly, put ratio back spreads (PRBS) a couple of days ago were advocated, wherein short leg is functioning as the underlying spot FX keeps spiking, we would like to uphold the same strategy on hedging grounds.

Both the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price rallies and bidding theta shorts in short run and 3m risks reversals to optimally utilize Vega longs.

On hedging grounds, fresh Vega longs for long-term hedging, more number of longs comprising of ATM instruments and ITM shorts in short-term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 2w (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spike mildly), simultaneously, go long in 2 lots of vega long in 1m ATM -0.49 delta put options. A move towards the ATM territory increases the Vega, Gamma, and Delta which boosts premium.

Thereby, the above positions address both upswings that are prevailing in short run and bearish risks in long run by vega longs.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards -33 levels (which is bearish), while hourly USD spot index was at -30 (bearish) while articulating (at 06:10 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty