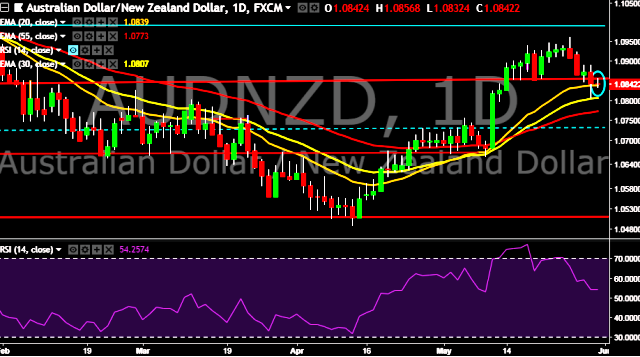

- AUD/NZD is currently trading around 1.0837 marks.

- Pair made intraday high at 1.0856 and low at 1.0832 marks.

- Intraday bias remains slightly bearish till the time pair holds key resistance at 1.0890 mark.

- A sustained close above 1.0842 will drag the parity higher towards key resistances at 1.0890/1.0927/1.0998/1.1072/1.1122 levels respectively.

- Alternatively, a daily close below 1.0842 will take the parity down towards key supports around 1.0795/1.0736/1.0620/1.0572/1.0506 marks respectively.

- Important to note here that 20D, 30D and 55D EMA heads up and confirms the bullish trend in a daily chart. Current downside movement is short term trend correction only.

- Australia Q1 capital expenditure increase to 0.4 % (forecast 0.7 %) vs previous -0.2 %.

- Australia April private sector credit decrease to 0.4 % vs previous 0.5 %.

- Australia April housing credit decrease to 0.4 % vs previous 0.5 %.

- Australia Q1 building capex increase to -1.3 % vs previous -2.1 %.

- Australia Q1 plant/machinery capex increase to 2.5 % vs previous 2.2 %.

- Australia's S&P/ASX 200 index up 0.66 pct at 6,024.40 points in early trade.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest