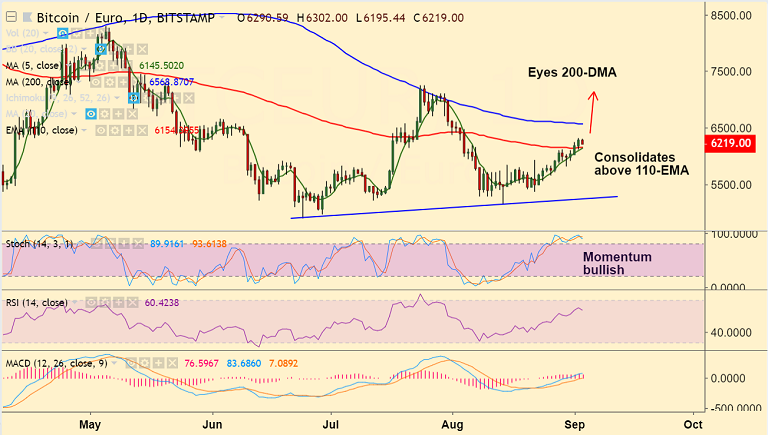

- BTC/EUR has shown a break above 110-EMA raising scope for further upside.

- The pair is currently consolidating in narrow range, trades 1.02% lower on the day.

- Price action is grinding higher along 5-DMA support, bias higher.

- Momentum studies are bullish and RSI has edged above 60 levels. DMIs also support upside in the pair.

- The pair has edged above 6200 mark, and further bullish momentum is likely to see test of 200-DMA.

- On the flipside 110-EMA is immediate support at 6154. Break below to see minor weakness. Retrace below 55-EMA to see major weakness.

Recommendation: Good to stay long on dips, SL: 6100, TP: 6568 (200-DMA), 6600, 6750 (trendline)

FxWirePro Currency Strength Index: FxWirePro's Hourly BTC Spot Index was at 29.3065 (Neutral), while Hourly EUR Spot Index was at -83.1102 (Bearish) at 1045 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary